Trading card games (TCGs) have been around since the 90s with Magic the Gathering, attracting collectors and speculators alike. Pokémon cards in particular have spawned a multi‑billion‑dollar secondary market built on trust, grading services and physical shipping. According to The Pokemon Company, a total of 75 Billion Pokemon cards are circulating to-date.

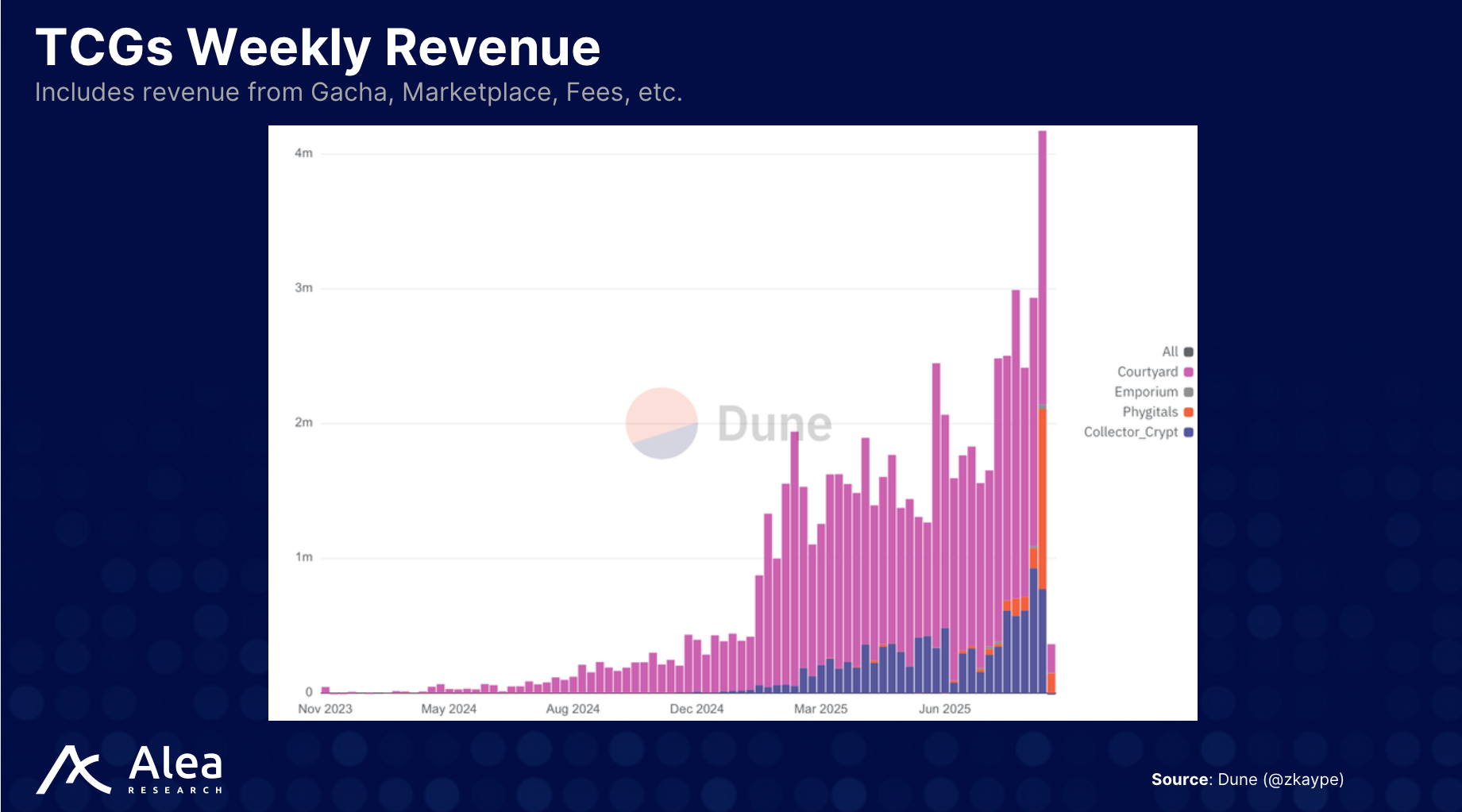

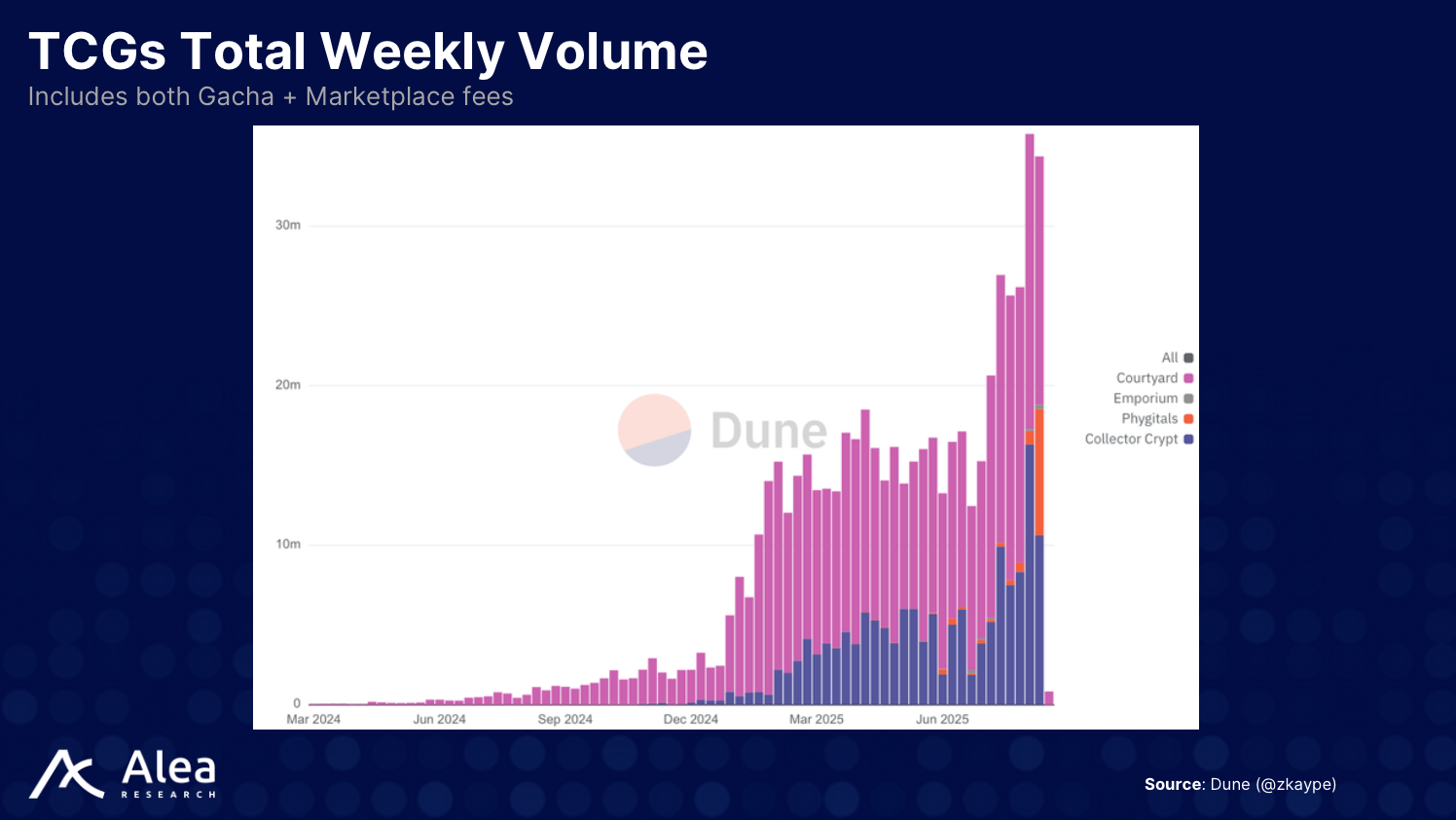

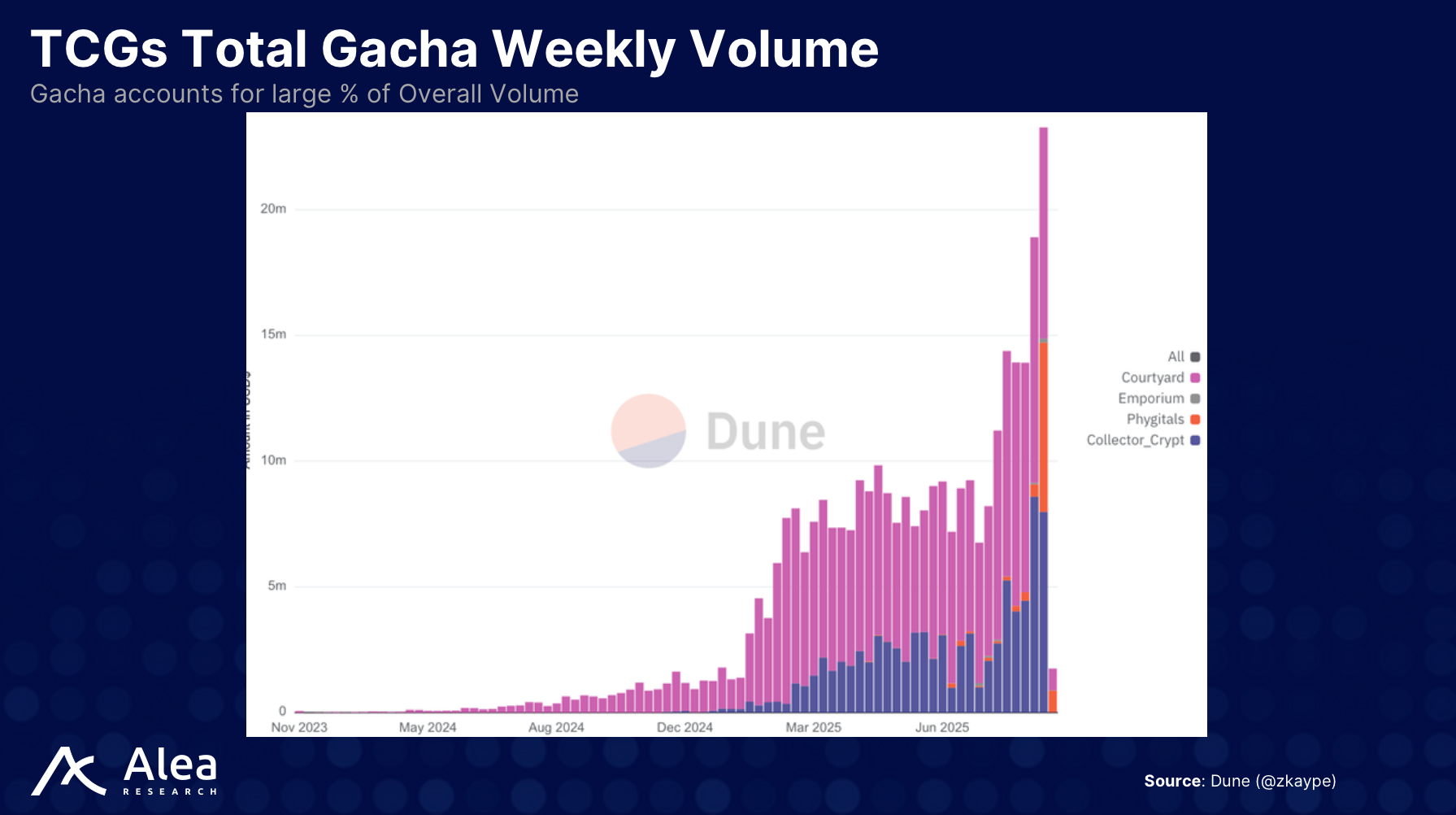

Recent crypto innovations are bringing these collectibles on‑chain. Platforms like Collector Crypt, Phygitals and Emporium tokenize graded cards as NFTs, offer instant buy‑back guarantees and operate gacha‑style vending machines that deliver random packs. This new market now generates over $4M in weekly revenue and transacting $35M in weekly volumes, and its still rapidly growing.

In this edition, we’ll look into the rise of on‑chain TCGs, examine Collector Crypt’s model and metrics, and explore the broader opportunity for tokenized collectibles.

Stay informed in the markets ⬇️

TCGs As the New RWAs

Treasuries or real estate are traditional RWA sectors where blockchain mainly improves settlement speed. Trading cards on the other hand are an untapped retail market growing at a 7.9% CAGR and it is expected to be an $11.8 billion market by 2030.

The physical trading card market is enormous. Whatnot, a social auction platform, processed $3 billion in sales last year, much of it Pokémon cards. Tokenized cards therefore could become the first widely accessible (and much more liquid) investment vehicle for collectibles. With gacha machines, platforms effectively run high‑margin, high‑volume vending businesses, turning cultural enthusiasm into recurring revenue. Admittedly, this creates a gambling-esque mechanic that is now much more accessible.

Why Tokenize Trading Cards?

Traditional TCG marketplaces rely on physical custody, third‑party grading and lengthy settlement. Buyers and sellers must trust condition reports and often wait days for cards to ship. Because of this, there are various instances of scams involving collectible cards, and illiquid (often only peer-to-peer) markets make it hard to participate in.

Tokenizing cards addresses these pain points by:

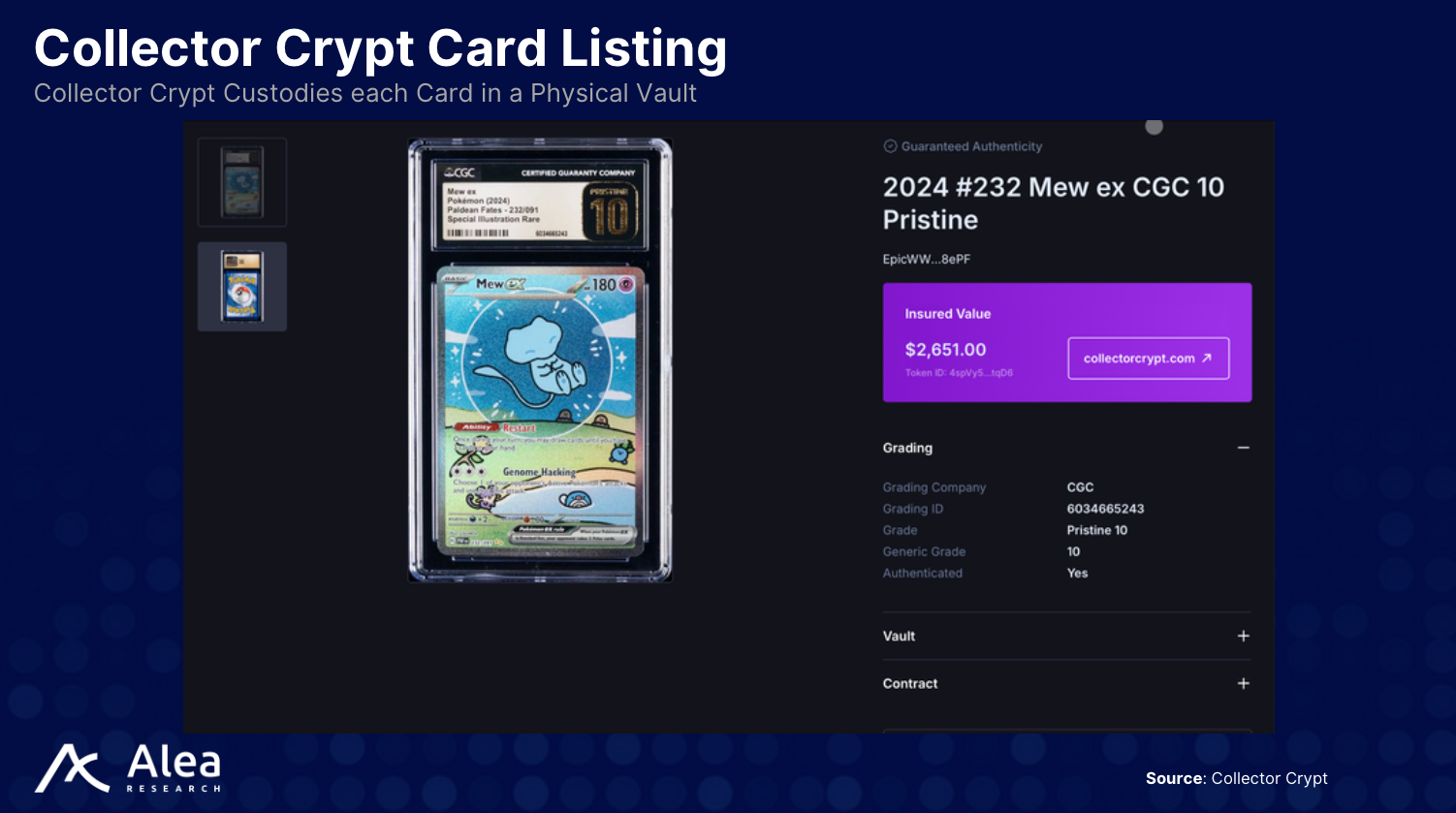

Digitizing provenance and ownership – Each token represents a specific card vaulted with a custodian. Ownership can be transferred instantly without moving the physical card.

Providing instant liquidity – Platforms like Collector Crypt offer buy‑back mechanisms allowing gacha customers to redeem NFTs for 90 % of the card’s value, ensuring holders can exit positions quickly (more on this later).

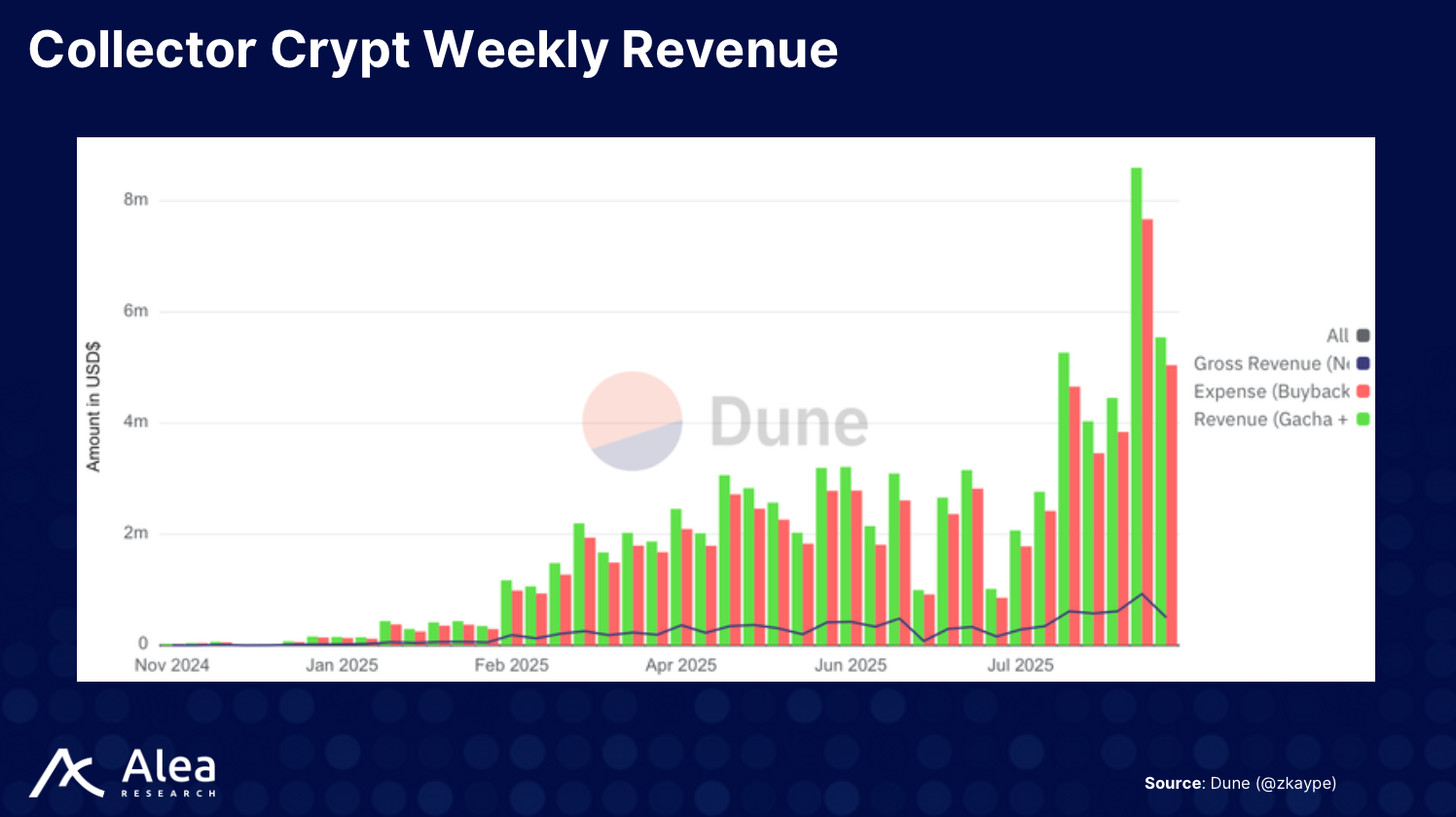

Creating new distribution mechanics – “gacha machines” let users purchase random packs, replicating the thrill of opening physical booster packs but with transparent expected values derived from live price feeds. Collector Crypt’s gacha machine generated $16.6 million in sales in one week.

Enabling DeFi integrations – Tokenized cards open up opportunities into DeFi beyond purely collecting or flipping, allowing it to be used as collateral for loans or paired with yield‑bearing strategies.

Introduction to Collector Crypt

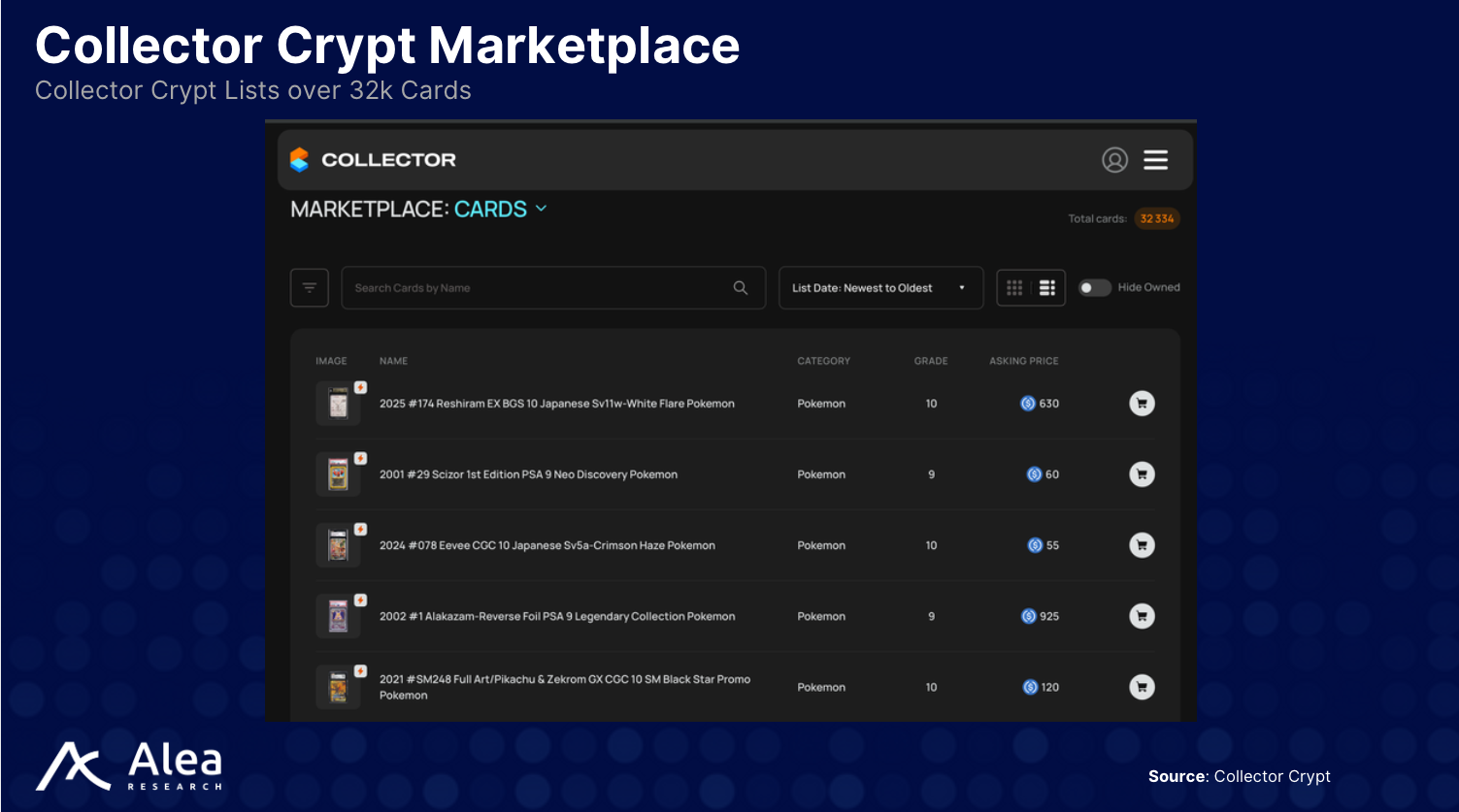

Collector Crypt tokenizes physical Pokémon cards vaulted in secure facilities. Customers can either buy specific cards on an open marketplace or try their luck with gacha pulls (50 USDC per pull).

Each NFT is backed by a real card and can be redeemed or sold.

For gacha machines, Collector Crypt publishes expected value calculations based on recent auction prices, giving users transparency. A typical pack offers a 20-25% chance to win a “big hit” worth more than the cost of entry. Rare pulls include PSA‑graded Charizards and Mario Pikachu cards, which can easiy fetch 5-figures.

The platform’s $CARDS token acts as a loyalty and fee‑sharing asset. Trading volumes surge because of the buy‑back guarantee where Collector Crypt buys back cards at 90 % of market value removing the need to wait for a counterparty.

Other projects in the space are also jumping on the TCG bandwagon:

TCG Emporium caters to high‑end collectors with curated, limited‑edition packs

Phygital emphasises dynamic pricing

Courtyard aims to bring mainstream brands like Marvel and sports leagues into the space. They also recently raised $30M led by Forerunner.

Market Traction and Metrics

The on‑chain TCG sector quickly gained product‑market fit with the leading platforms collectively processing tens of millions in sales to-date.

Courtyard - total gross revenue of $54.21m

Collector Crypt – total gross revenue of $10.21m

Phygitals – total gross revenue of $2.11m

Emporium – total gross revenue of $108k

For Collector Crypt, marketplace fees, gacha fees and secondary sales all contribute to revenue, projected to reach $38 million annually at current run rates. Fees are distributed to $CARDS token holders via buy‑backs.

Gacha also appears to be the main volume contributor across all platforms, amounting to >50% of weekly volumes on average.

Conclusion

On‑chain TCGs are transforming hobby collectibles into liquid, composable assets. Their rapid growth and traction with multi‑million‑dollar weekly volumes, tens of millions in revenue, and soaring token valuations signals strong product‑market fit.

The broader opportunity is clear: tokenized collectibles represent a new frontier for RWAs, unlocking access to collectible assets that have long been illiquid. As more platforms launch and institutional funding flows in, expect on‑chain TCGs to become a meaningful pillar of the RWA narrative alongside just as treasuries, real estate and equities.