LayerZero was founded on the idea that blockchain applications should not be confined to individual chains. Instead of building one bridge per network, LayerZero provides a messaging layer that connects smart contracts across more than 130 blockchains, enabling tokens and data to move seamlessly without custodial bridges.

In 2025, this omnichain thesis is evolving beyond DeFi and new primitives are emerging for real‑world asset settlements, regulated finance and universal data queries.

In this edition, we’ll look into lzRead and BQL, real‑world asset infrastructure via XDC and cross‑chain DvP, and the introduction of one‑click LP migrations.

Stay informed in the markets ⬇️

Introduction to LayerZero

At its core, LayerZero is a protocol for sending messages across blockchains. Each supported chain hosts an Endpoint which is a smart contract that emits events when a dApp sends a message. Off‑chain actors called Decentralized Verifier Networks (DVNs) verify that the message actually occurred.

Once verified, Executors deliver the message to the destination chain, triggering the appropriate function. This modular design separates verification from execution, allowing applications to choose the security providers that match their risk profile. The result is a low‑latency, censorship‑resistant messaging layer that sits beneath cross‑chain applications.

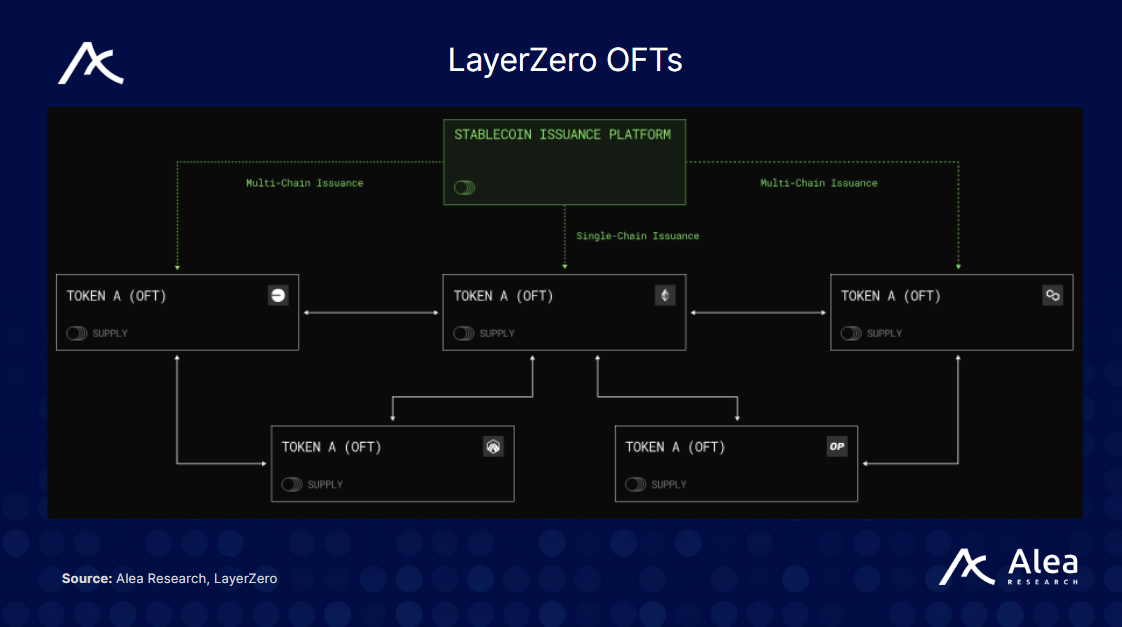

LayerZero’s Omnichain Fungible Token (OFT) standard extends this messaging layer to assets. Rather than using wrapped tokens, an OFT uses a burn‑and‑mint model where tokens are burned on the source chain and minted on the destination chain, preserving a unified supply.

Stablecoin issuers like Tether, Ethena and PayPal’s PYUSD now use this model to expand to new chains, and LayerZero’s messaging volume accounts for over 70 % of the total stablecoin market cap. With more than 14 of the top 55 stablecoin issuers adopting the OFT standard and messaging live on 132 networks, LayerZero has become the default connectivity layer for multichain liquidity.

lzRead and the Blockchain Query Language (BQL)

LayerZero’s latest primitive, lzRead, introduces a way for smart contracts to query data across chains without sending messages back and forth. Using the Blockchain Query Language (BQL), developers can request real‑time, historical or range‑based data from any supported chain or even off‑chain sources.

Instead of push‑based messaging, lzRead uses a pull model where a contract on one chain encodes a query, which is forwarded to DVNs where they fetch and compute the result, then return the answer in a single response. This drastically reduces gas costs and latency for cross‑chain queries, enabling use cases such as:

Cross‑chain governance: Voting contracts can read token balances on other chains to determine quorum without bridging assets.

Proof‑of‑reserve and price feeds: DeFi protocols can verify collateral on remote chains or fetch price histories in a single call.

Cross‑chain DEX analytics: A DEX on one chain can query trading volumes and liquidity on another chain without deploying oracles

XDC Network Integration: Bringing RWA to the Omnichain

In April, LayerZero went live on the XDC Network, a hybrid chain designed for enterprise and trade finance. This integration connects XDC to more than 125 blockchains, unlocking omnichain application development for real‑world asset (RWA) use cases.

Key benefits highlighted by the XDC Foundation include:

Omnichain dApp development: Developers can build dApps on XDC that communicate with 125+ other chains. For example, a lending protocol on XDC can accept collateral from Ethereum or Solana without users leaving the interface

Permissionless, censorship‑resistant messaging: LayerZero’s immutable Endpoints ensure messages are verified by DVNs and executed without centralized control.

Seamless cross‑chain interactions: Users can move assets and data between XDC and other networks e.g., a tokenized invoice on XDC can be bridged to Polygon for DeFi liquidity.

Enhanced trust and efficiency: Decentralized infrastructure improves reliability, attracting enterprises to cross‑chain operations.

One‑Click Liquidity Migration

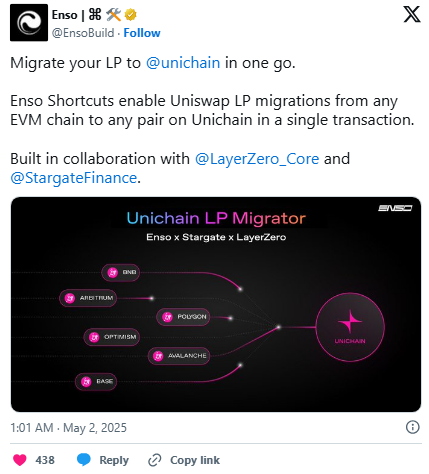

LayerZero partnered with Enso and Stargate to launch a one‑click liquidity migration tool that can migrate up to $3.5 billion of Uniswap v2 and v3 positions to Unichain.

Historically, moving liquidity to a new chain required as many as nine steps; the new solution compresses this into a single transaction, allowing LPs to bridge, unwrap and redeploy liquidity at once.

Enso handles the DeFi execution, Stargate provides the unified bridge, and LayerZero relays messages across chains.

By simplifying cross‑chain migrations, this product demonstrates how LayerZero can unlock capital efficiency for DeFi protocols and accelerate the adoption of new networks.