LiquidOps went live on AO earlier this year, introducing native lending, borrowing, and liquidation infrastructure to a network historically known for permanent storage. While niche and still in early stages, LiquidOps reflects the steady migration of DeFi primitives into purpose-built, non-EVM ecosystems and the potential for deeply integrated, low-level financial tooling in new L1 environments.

In this edition, we’ll write a short primer on what LiquidOps is building, its unique integration with the AO runtime, and why this small protocol may be a leading indicator of what “DeFi on Arweave” could become.

Stay informed in the markets ⬇

Introduction: Native DeFi on Arweave’s AO

LiquidOps is a decentralized lending and borrowing protocol built from the ground up for AO, Arweave’s new compute-oriented execution layer. Unlike Ethereum or Solana-based protocols which rely heavily on modular architecture and third-party middleware, LiquidOps integrates directly into AO’s runtime stack, offering collateralized lending and liquidation flows native to the ecosystem.

The protocol enables users to lend assets to earn yield, borrow against overcollateralized positions, and participate in liquidations. It also offers a fully documented SDK and developer toolkit, designed to make financial tooling on AO programmable and composable for future applications, including AI-native agents and autonomous market strategies.

By anchoring DeFi primitives directly within AO’s architecture, LiquidOps represents an early attempt to define how financial services may operate natively in Arweave’s growing computational ecosystem without relying on legacy L1 infrastructure or EVM compatibility.

Mainnet Launch & Ecosystem Scope

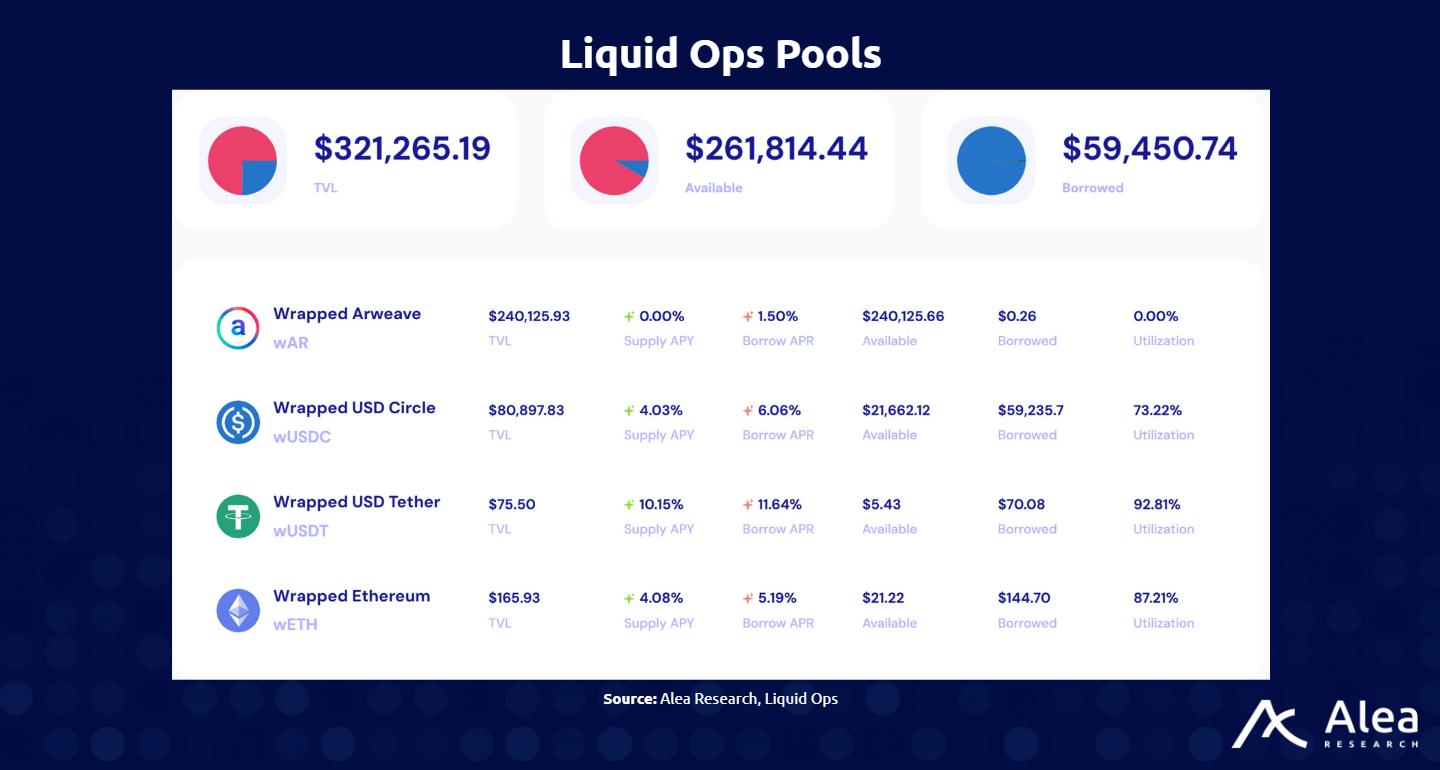

Following its testnet in early 2025, LiquidOps deployed its mainnet beta in March with core functionality live at launch: lending, borrowing, liquidations, and collateral management. While activity remains small, the protocol is designed for extensibility, and has opened up SDK-level access for developers to build on top of its infrastructure.

Importantly, LiquidOps is one of the first DeFi protocols on AO. AO’s architecture is uniquely suited for persistent agent-based computation, and LiquidOps aims to complement that by offering financial railways for agents to earn, borrow, and transact without external dependencies. Early documentation shows the protocol’s interest in supporting features like cross-collateral lending (aggregating risk-adjusted baskets of tokens for improved capital efficiency), as well as real-time interest rate adjustments using a Jump Rate model similar to Aave or Compound.

Protocol Design and Collateral Mechanisms

At its core, LiquidOps relies on overcollateralized lending where borrowers lock up more collateral than the value of their loans and maintains solvency through a liquidation engine structured around a Dutch auction mechanism.

Key components include:

Jump Rate Interest Model: Rates adjust gradually under normal utilization but spike rapidly when demand surges, disincentivizing overborrowing and preserving pool liquidity.

Cross-Collateral Support: Users can pledge a basket of tokens (e.g., AR, STAMP, AO-native assets) as joint collateral, reducing liquidation risk and unlocking greater borrowing power.

Dutch Auction Liquidations: Collateral at-risk is auctioned at a fixed discount that decays over time, encouraging rapid repayment and minimizing bad debt.

Leverage Loops: Advanced users can borrow stablecoins (e.g., USDA), recycle them into assets like AR via AO-native DEXs, and recursively re-collateralize, enabling decentralized leverage with native execution paths.

This toolkit gives LiquidOps the foundation to offer not just basic lending and borrowing, but to serve as a backend for more complex agent-based DeFi strategies once the AO ecosystem matures.

LiquidOps also recently introduced its native governance token, $LQD.

The token’s design is anchored on two pillars: protocol governance and incentive alignment.

Governance: $LQD holders steer the protocol by voting on risk parameters (e.g., collateralization ratios, supported assets), interest models, and treasury deployment.

Incentives: The token will be used to bootstrap liquidity, reward early contributors, and distribute protocol value back to its users.

Notably, LiquidOps accrues value to depositors via interest-bearing tokens, meaning users can earn passive income while participating in governance if they hold $LQD alongside lending positions. By embedding governance directly into the user reward loop, LiquidOps ensures that its user base has both financial and directional control, positioning it as a credibly neutral primitive for the broader AO stack.

Important Links