Ondo has quickly emerged as one of the most ambitious builders in the RWA tokenization space. Founded to bridge institutional finance with open blockchains, Ondo is now transforming into a full‑stack platform for regulated, on‑chain capital markets.

Over the past month, they launched the $250 million Ondo Catalyst initiative, announced two high‑profile acquisitions and extended its ecosystem to new blockchains and on‑ramps. The momentum underscores its mission to make tokenized securities, stablecoins and yield products accessible to a global audience.

In this edition, we'll explore the Catalyst investment program, key acquisitions and regulatory milestones, and ecosystem expansions in July 2025, and more.

Stay informed in the market ⬇️

The Foundation of Ondo

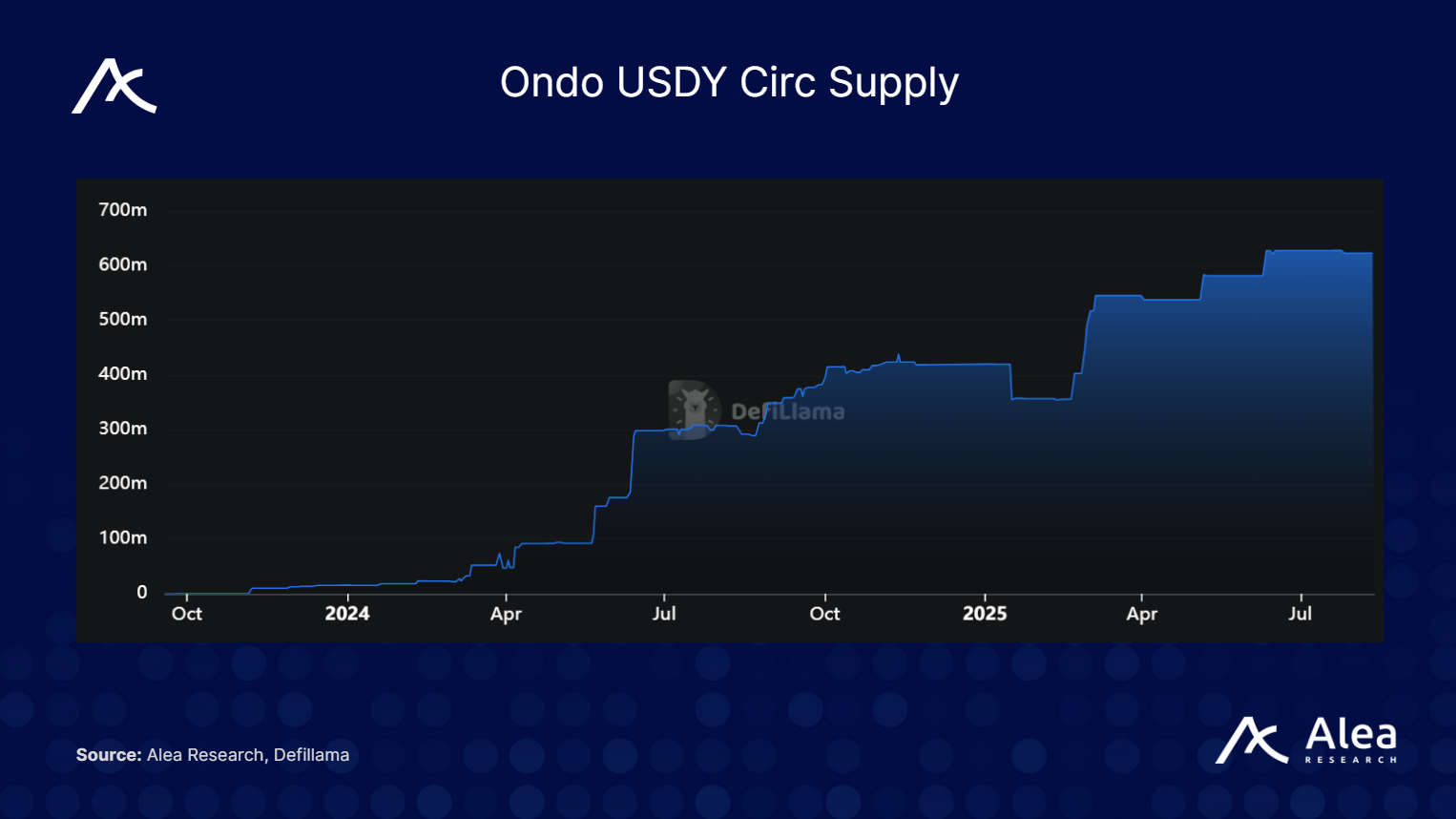

Ondo Finance started as a DeFi protocol offering yield‑bearing tokens backed by real assets such as short‑term US Treasuries. Its flagship product, USDY, provides a yield on stable collateral, allowing investors to earn U.S. treasury‑linked income on‑chain. As part of its broader roadmap, Ondo seeks to bring entire securities markets on‑chain, working closely with regulators to ensure compliance.

Unlike many DeFi projects that operate in regulatory grey zones, Ondo has focused on obtaining proper licenses and building infrastructure that institutional investors can trust, being featured in a White House digital‑asset report. This includes plans for its own blockchain to support regulated trading and settlement, and partnerships across multiple ecosystems.

Expanding On‑Chain Capital Markets

In early July, Ondo launched Ondo Catalyst, a $250 million strategic investing initiative designed to accelerate the development of on‑chain capital markets. Backed by venture firm Pantera Capital, Catalyst aims to deploy capital into protocols and infrastructure that expand the use of tokenized securities and RWAs. By seeding projects building custody, compliant issuance and secondary trading, Ondo seeks to nurture an ecosystem around its own offerings.

Strategic Acquisitions

Acquisitions underscore Ondo’s strategy of vertical integration by building both the technical stack and regulatory framework required to bring financial markets on‑chain. They recently made 2 key acquisitions:

Strangelove – Stragelove is a blockchain development company known for building secure and modular infrastructure across multiple ecosystems. Strangelove’s team has contributed to interoperability protocols, SDK frameworks and custom chain deployments. The acquisition expands Ondo’s engineering and product capabilities, positioning it as the only RWA platform with omnichain asset issuance, protocol design and blockchain‑development expertise. Strangelove CEO Jack Zampolin will join Ondo as VP of Product, bringing deep experience in protocol design and go‑to‑market execution.

Oasis Pro – Oasis Pro is an SEC‑registered broker‑dealer, alternative trading system (ATS) and transfer agent. This move gives Ondo regulated licenses necessary to develop a compliant tokenized securities ecosystem for U.S. investors. Integrating Oasis Pro’s infrastructure will allow Ondo to list and trade on‑chain versions of stocks, bonds and other securities in a legally compliant manner.

Ecosystem Expansions

Global Markets Alliance – The Global Markets Alliance, a consortium promoting interoperability standards for tokenized securities, grew to 25 members. New joiners include BNB Chain, Bitget Global, LayerZero, Euler and MEXC. The alliance’s growth signals increasing industry coordination around common standards, which is vital for liquidity and cross‑chain settlement.

USDY on Sei Network – Ondo’s USDY will launch on the Sei L1, designed for high‑performance, capital‑efficient applications. Expanding USDY to multiple chains enables users to access fixed‑income products without bridged custodianship and helps Ondo tap into different DeFi ecosystems.

Global Fiat On‑Ramp – Alchemy Pay integrated USDY into its fiat on‑ramp, allowing users in 173 countries to purchase with familiar payment methods such as Visa, Mastercard, Apple Pay, Google Pay and local bank transfers. This integration lowers entry barriers for mainstream users and increases potential demand for USDY.