DeFi has spent the last several years building high‑throughput trading venues, sophisticated yield primitives and on‑chain money markets. Yet one critical function remains largely absent: a neutral clearing layer that nets risk across positions and venues.

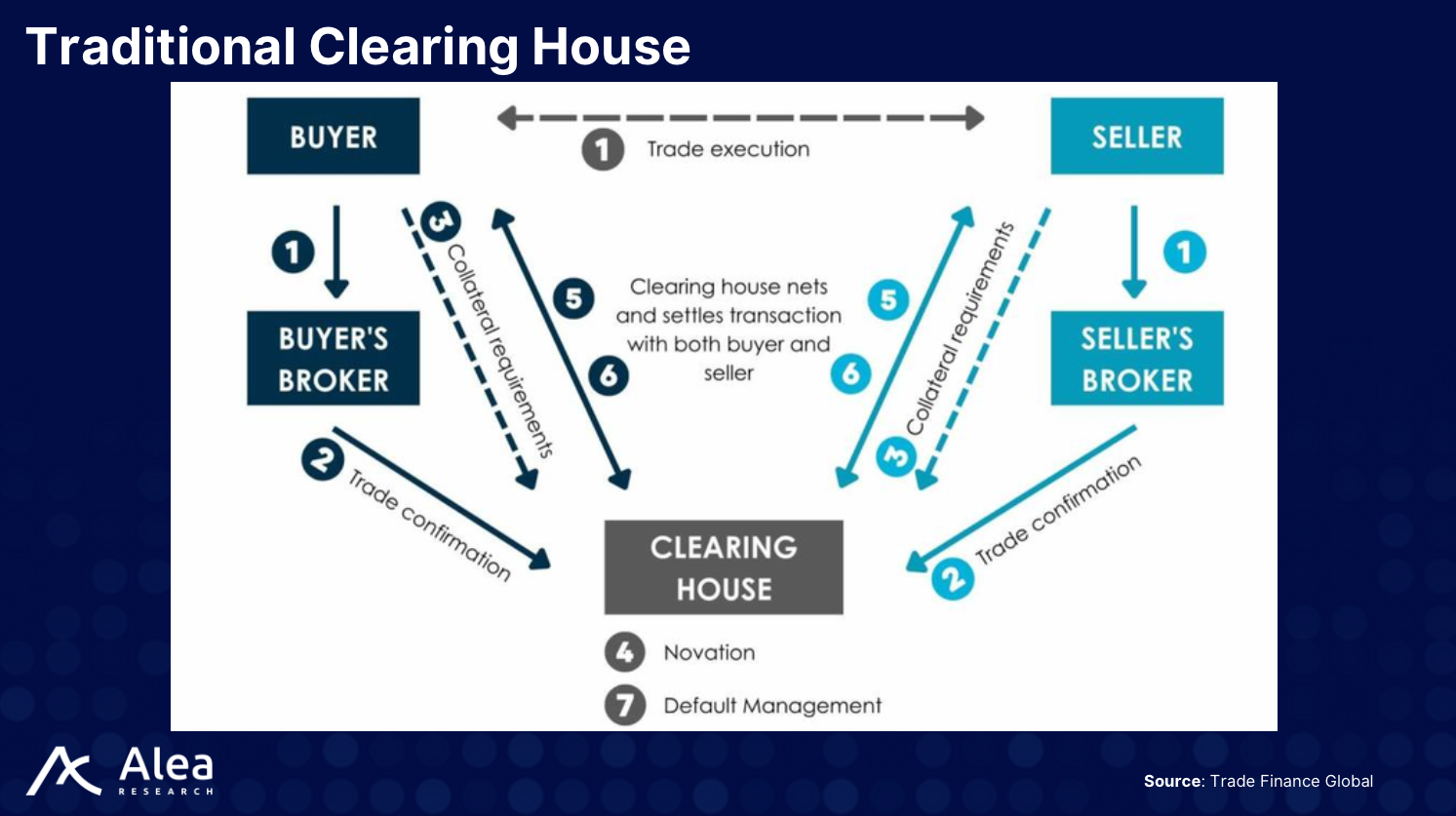

In traditional markets, clearing houses such as LCH and CME sit between counterparties, netting exposures, enforcing margin rules and mutualizing risk.

DeFi’s fragmentation and over‑collateralization show what happens without proper clearing infrastructure as exchanges silo the risk logic, overlock collateral and still suffer periodic blow‑ups. A potential $35 trillion opportunity in on‑chain derivatives and RWA markets are being entirely overlooked.

Pascal Protocol aims to be the clearinghouse for DeFi, providing neutral middleware that calculate margin using portfolio netting and VaR‑based models, enforce liquidations deterministically and allow exposures to be netted across platforms.

In this edition, we explore the Clearing opportunity, Pascal’s solution and the upcoming $PASC TGE.

Stay informed in the markets ⬇️

Why DeFi Needs Clearing

Clearing happens between a trade and its settlement where the movement of money and assets goes to the right parties, at the right time, without counterparty risk. Clearing houses net exposures and calculate margin across positions, ensuring that participants only post the collateral necessary to cover real risk.

In DeFi, this layer is almost non‑existent.

Every venue demands its own collateral, ignoring cross‑asset correlations. Positions are also managed in isolation, and when volatility spikes, liquidations cascade across protocols. To stay safe, some platforms lock up 150–200 % collateral while others cut corners and create systemic fragility. This fragmentation makes it impossible for on‑chain derivatives to scale to their true potential.

Pascal’s team argues that universal clearing is essential for unlocking capital efficient DeFi products. By netting exposures across exchanges and products, margin requirements can drop dramatically, similar to how portfolio margining in TradFi frees capital for hedged strategies.

With a neutral clearing layer, a trader could go long BTC, short ETH and sell covered calls on both, posting collateral only for the net risk. The result is deeper liquidity, lower capital costs and a safer system for all participants.

Market Momentum & Opportunity

Pascal’s ambition extends beyond crypto perps. The protocol sees a future where RWA derivatives, interest‑rate products and cross‑asset structured trades are cleared on‑chain.

Its recent partnership with Treehouse to develop decentralized fixed‑income markets suggests a pipeline of products that require sophisticated margining.

The opportunity is enormous with global derivatives markets dwarfing spot markets in notional volumes, and traditional clearinghouses like LCH or CME collecting billions in fees each year. To put things into perspective, LCH’s Swapclear (interest rate swaps) arm alone clears over $1 Quadrillion in notional volume annually.

By bringing these economics on‑chain, Pascal positions itself as the LCH/CME of DeFi, capturing value from every venue that plugs into its clearing infrastructure.

Pascal’s Clearing Engine

Pascal’s solution is to introduce a modular clearing engine that any exchange, DAO or protocol can plug into. Key features include:

Portfolio Netting: Pascal nets risk across multiple positions and venues, offsetting exposures to reduce collateral requirements.

VaR‑Based Margining: Instead of fixed margin ratios, the engine calculates margin dynamically based on value‑at‑risk, reflecting real exposure and correlations.

Transparent Logic: All settlement and liquidation rules are enforced by smart contracts; risk parameters and calculations are auditable on‑chain.

Composable Infrastructure: Any DeFi protocol from perpetual DEXs to structured‑product issuers can integrate Pascal to outsource their risk management.

This approach unbundles risk management from order books and AMMs, turning clearing into a shared service. Jetstream, a derivatives DEX, clears every trade through Pascal, and partnerships such as Treehouse are testing smart clearing for decentralized interest‑rate products.

$PASC TGE & Governance

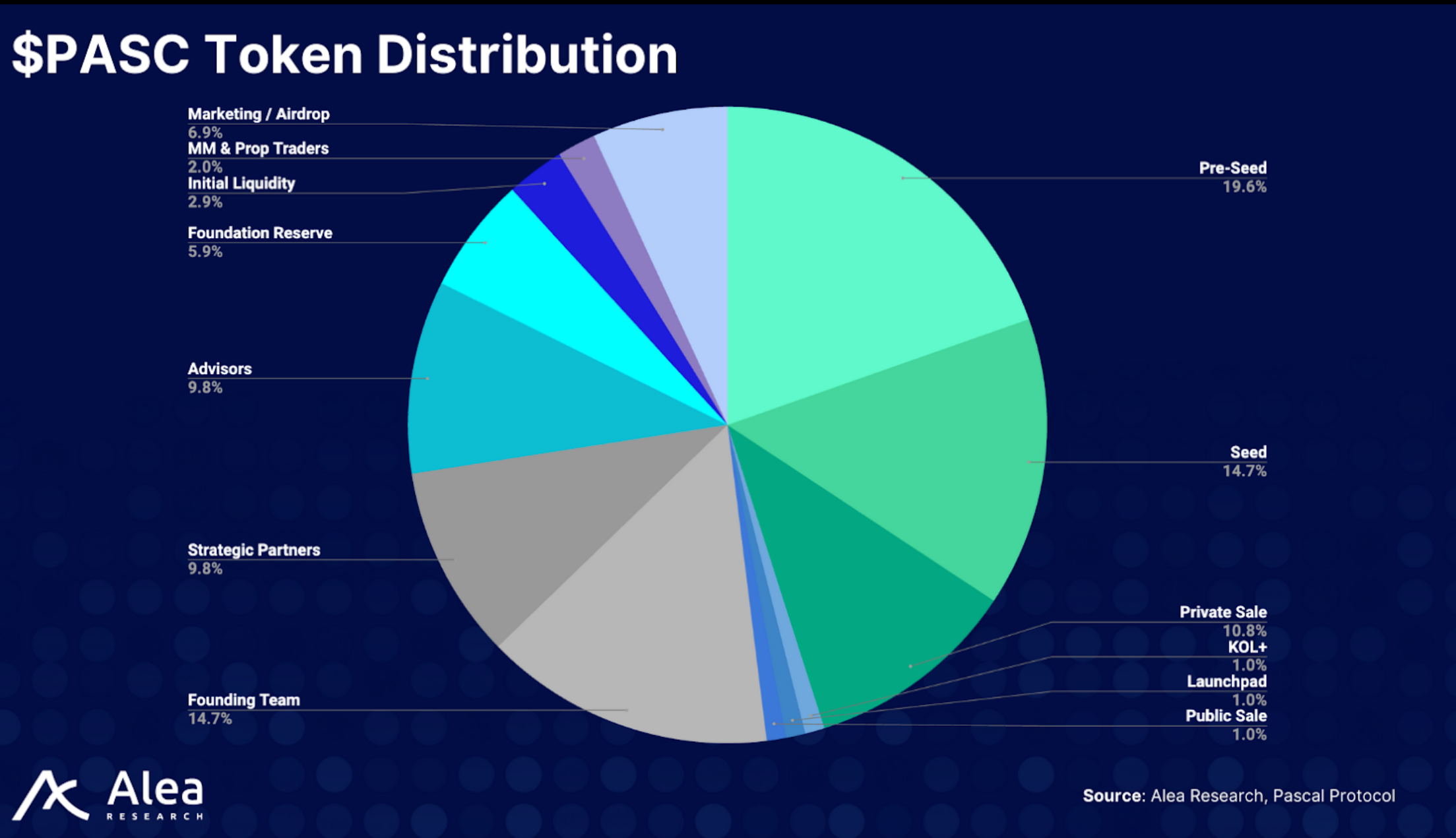

The $PASC token will TGE on 9 September, giving holders a stake in the clearinghouse. The token distribution will be as follows:

On top of that, $PASC stakers earn 15–35 % APY depending on their staking term, receive Jetstream points convertible to the $JETS token at Jetstream’s TGE, and share 20 % of Pascal’s fees in USDC.

There will be an initial unlock of about 6.5% of the supply and vesting to smooth selling pressure. Liquidity will be seeded via Uniswap, with LP incentives to deepen markets.

$PASC holders will be able to propose and vote on risk parameters, fee structures, new asset support and cross‑chain expansion.

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with Pascal as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.