Perpetual futures remain crypto’s most liquid and actively traded derivative instrument, accounting for over $400B in daily notional volume across centralized and decentralized exchanges. As capital becomes more sophisticated, the demand is shifting toward more complex strategies that mirror those deployed by hedge funds and quant desks in TradFi markets.

Pair trading is one such primitive. By simultaneously going long and short two correlated assets, traders can isolate relative value discrepancies and neutralize market direction risk. Historically, implementing these strategies required external tooling, manual rebalancing, or deploying capital across multiple legs and platforms. Pear Protocol abstracts away this operational complexity by introducing native on-chain pair trading through a single interface.

In this edition, we'll discuss Pear Protocol’s performance, Hyperliquid integration, and more…

Stay informed in the markets ⬇

Background on Pear Protocol

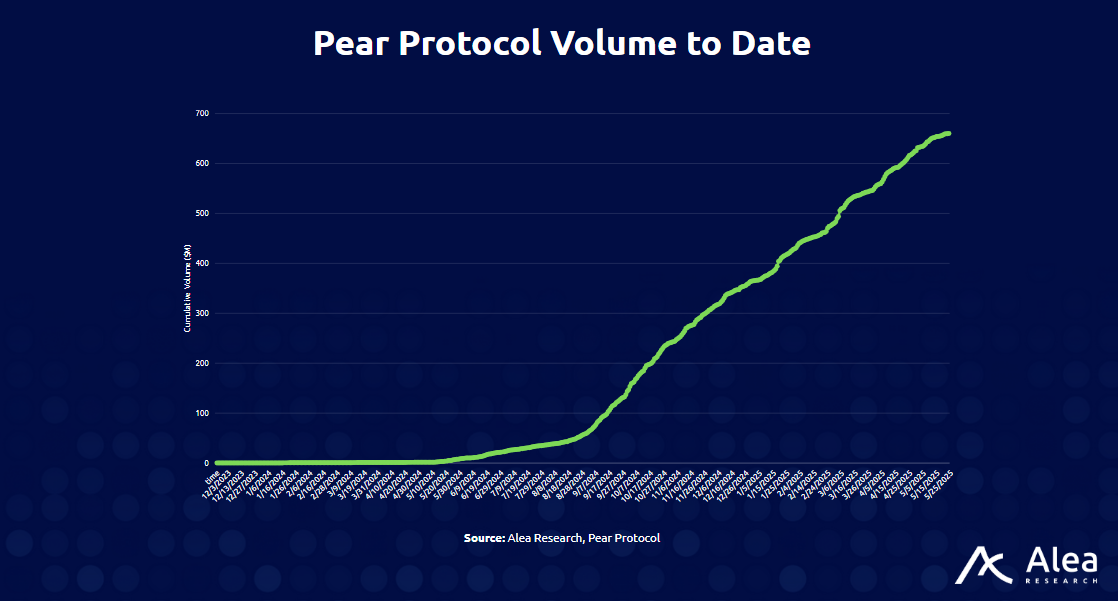

Pear Protocol is not a trading venue in itself, but an execution and strategy layer that sits on top of existing perpetual DEXs like GMX, Vertex, SYMM, and recently, Hyperliquid. To date, Pear has done over $660M in total volume.

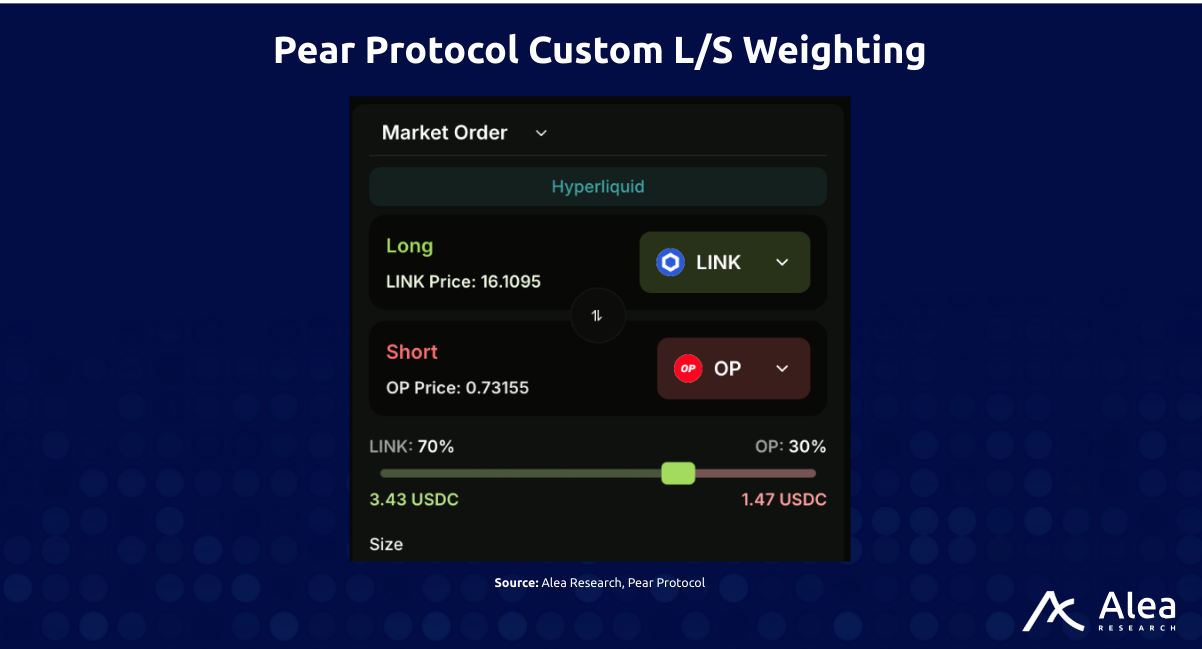

Their core product is a pair trade smart contract, allowing users to express long/short positions across two assets in a unified, capital-efficient structure. Traders can size each leg asymmetrically, monitor PnL on the spread ratio, and execute custom strategies without manually managing multiple isolated positions.

What differentiates Pear is its focus on modularity and advanced strategy tooling. The protocol supports features such as:

Ratio-Based Execution: All actions (limit orders, stop-loss, take-profit) are based on the performance of the asset ratio, rather than the individual assets themselves.

Custom Weighting: Users can allocate directional exposure based on conviction (e.g., 70% long ETH, 30% short SOL) rather than maintaining a fixed market-neutral stance.

TWAP Trading: Time-weighted execution helps reduce slippage, especially in volatile or less liquid pairs.

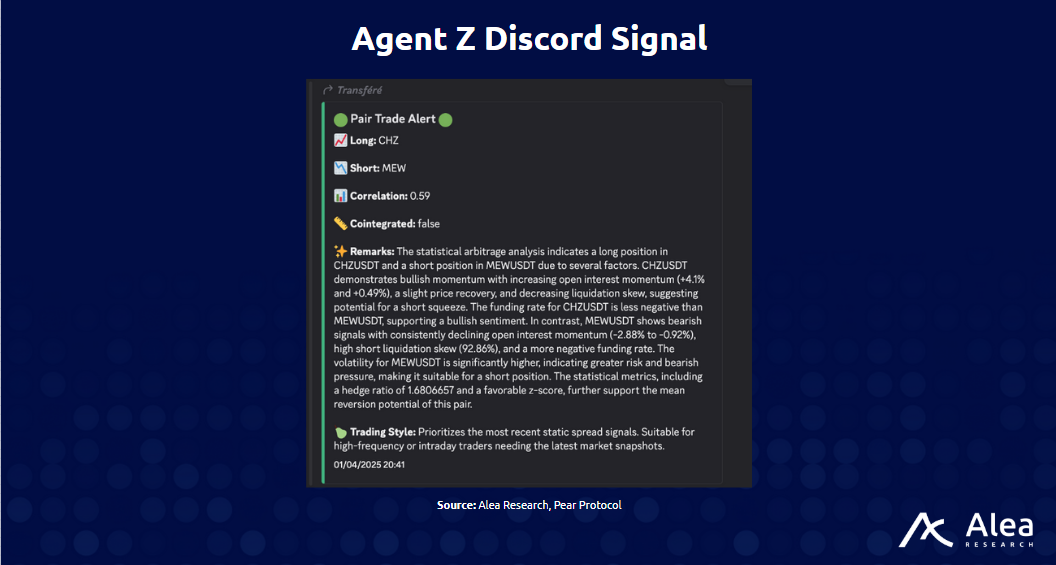

Pear is also looking to integrate an AI Agent known as Agent Pear, a native trade signal engine. The system surfaces pair opportunities using quantitative triggers (e.g., Z-score, funding rate divergence, open interest delta) and fundamental catalysts (e.g., token unlocks, Twitter sentiment shifts). The focus for the agent is on Z-score, which is a statistical measure that tells you how far a data point is from the mean, measured in units of standard deviation. In the context of pair trading, it allows traders to identify and quantify mean-reversion opportunities where the price relationship between two assets deviate from their typical behavior. A high or low Z-score suggests that the spread between the two assets is unusually wide or tight compared to historical norms.

This makes Pear not just an execution venue, but a full-stack platform for deploying and scaling statistical arbitrage strategies on-chain. The goal is to lower the barrier to entry for professional-grade trading strategies in crypto, bringing a new level of sophistication to DeFi-native market participants.

Hyperliquid Ecosystem

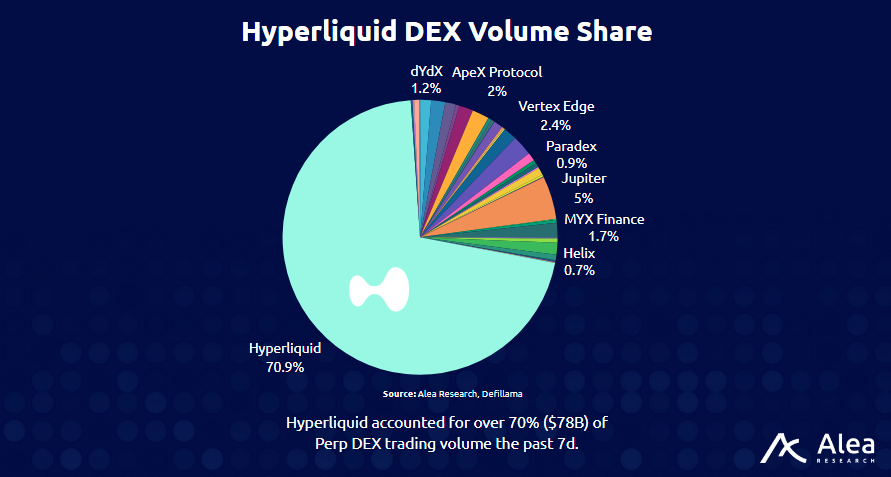

Hyperliquid has established itself as one of the largest Perp DEXs, boasting a 70% share of the entire perp DEX market volume.

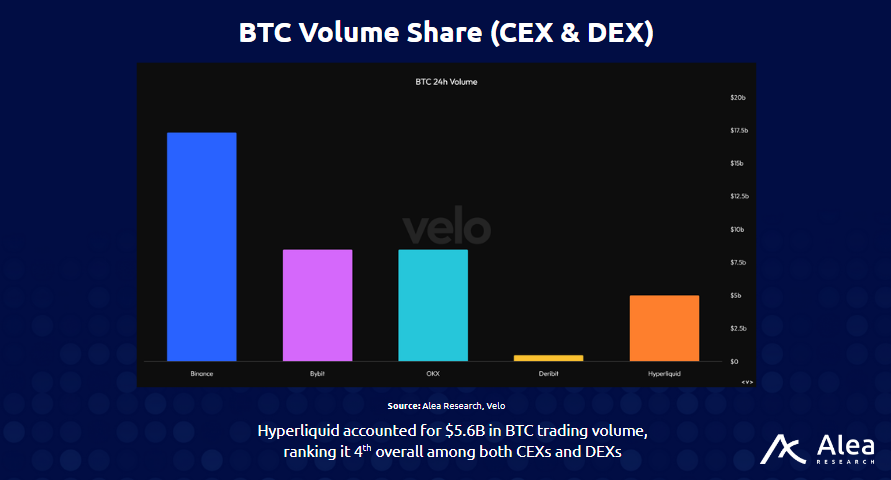

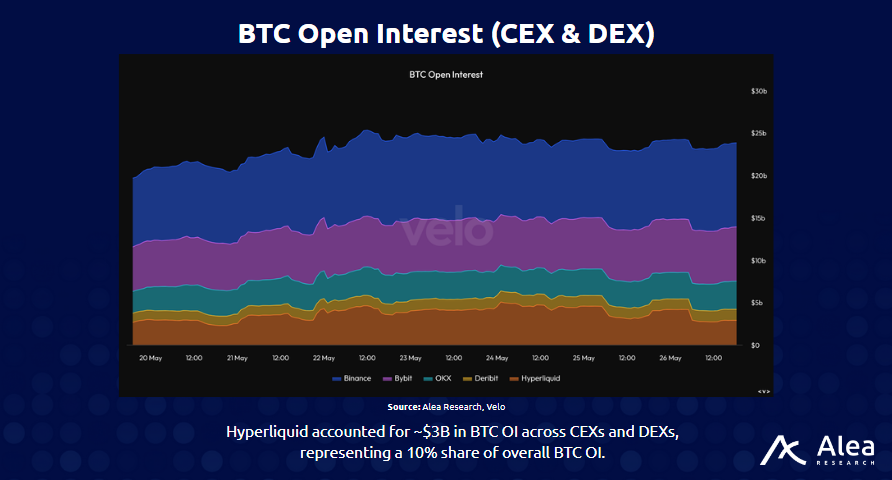

Additionally, Hyperliquid has also began to eat into CEX market share, solidifying itself as one of the top perpetuals trading protocols in the space. Looking at BTC’s trading volume and open interest across the entire crypto derivatives market, Hyperliquid is starting to catch up with major CEXs like Bybit and OKX.

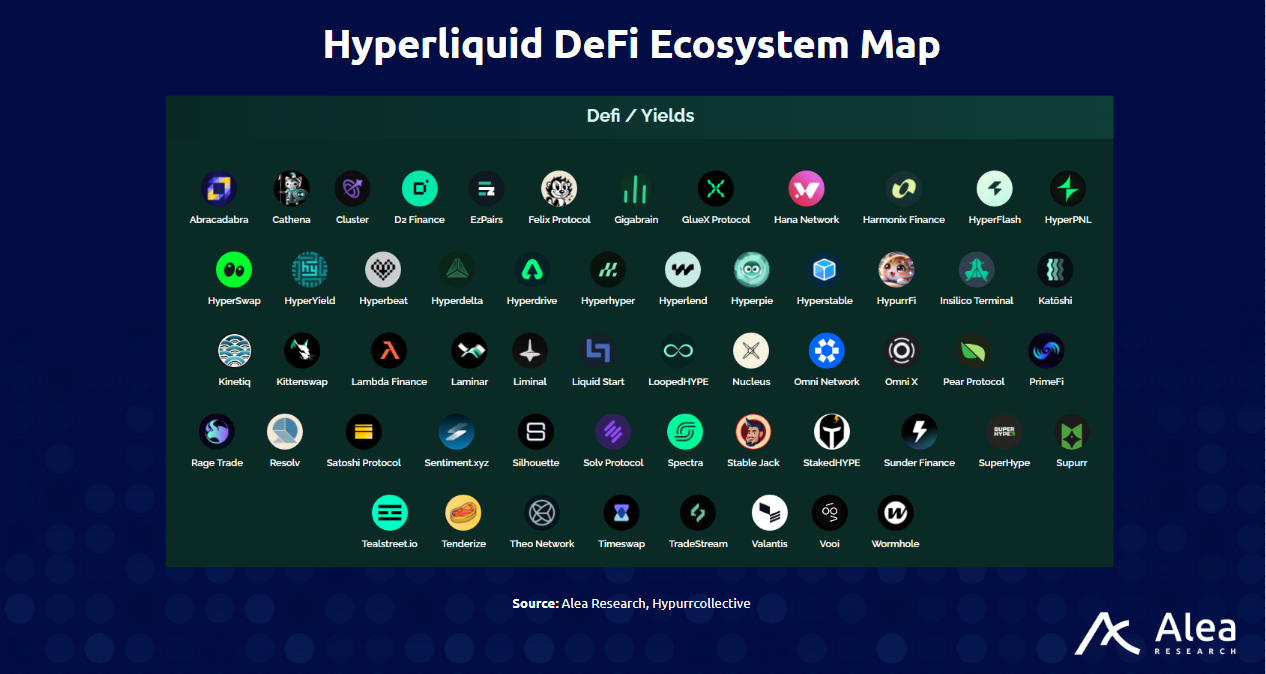

Pear Protocol is also one of Hyperliquid’s DeFi ecosystem partner, serving as a building block on top of the underlying protocol to provide an improved trading experience via pair trading.

Launch Campaign: Driving Engagement Through Gamified Trading

Pear Protocol is rolling out their Hyperliquid launch with a campaigned to accelerate user onboarding, trading volume, and product understanding. The goal is to blend competitive trading incentives with point-based gamification (HYPEAR points), targeting both seasoned onchain traders and newcomers to pair trading.

The Hyperliquid engine will be launched with a Leaderboard that will rank the addresses doing the most volume, activity, and also realized PnL. The more a user wins(pure PNL) the higher their ranks in the leaderboard, rewarding those who can consistently extract alpha through their pair strategies.

Running in parallel is the HYPEAR point system, a three-month incentive program created in collaboration with Fuul. A total of 1 million HYPEAR points will be distributed during this window. The exact scoring formula is deliberately opaque, but key contributors include:

Trading volume on Pear

Profitability (total PnL)

Holding duration of trades

Usage of advanced features (TWAP, Agent Pear, custom weightings)

These points will be redeemable for $HYPE tokens at the end of the campaign. Pear Protocol has already acquired a significant allocation of $HYPE to back this initiative, signaling commitment to long-term alignment with its user base.

Important Links

Disclosures

Alea Research is engaged in a commercial relationship with Pear Protocol as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.