Pendle’s 2025 roadmap is anchored around a multi-phase expansion plan to make every yield source in crypto tradable, hedgeable, and composable. After pioneering the liquid fixed-rate market for staking, airdrops, and points, Pendle is now tapping into perpetual funding rates vertical.

The launch of Boros marks the protocol’s boldest move yet transforming perps funding rate into tokenized, tradeable tokens. This lets traders lock in, hedge, or speculate on funding rates over fixed durations, creating an entirely new on-chain asset class.

In today’s edition, we’ll explore why funding-rate markets matter, how Boros’ new Yield Units (YUs) work, and why this unlocks a massive new fee engine and flywheel for Pendle’s economy.

Stay informed in the markets ⬇

Addressable Yield Market for Funding Rates

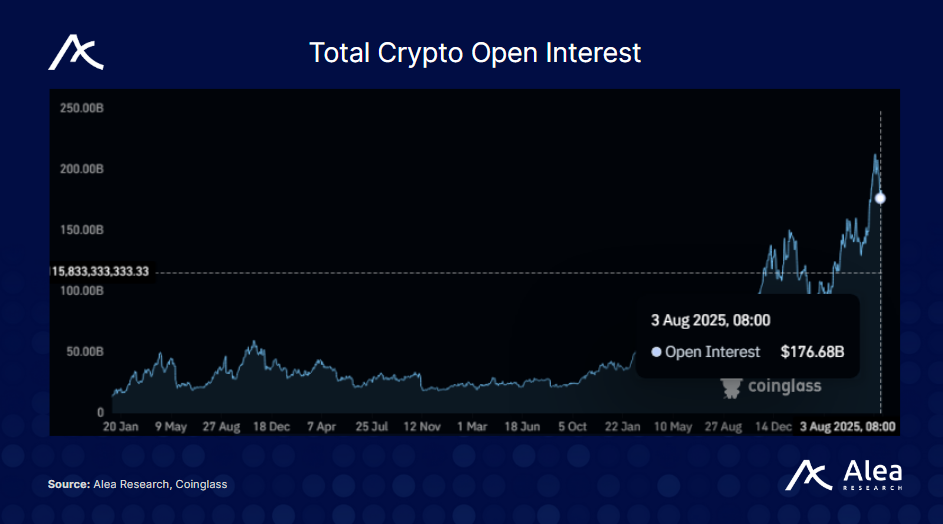

Perpetual futures remain crypto’s largest product class, with over $170B in open interest across major CEXs and DEXs like Binance, Hyperliquid, and Bybit. However, the perp funding rates have no liquid, composable, on-chain market. That’s a gap Pendle is now directly addressing with Boros which introduces tradeable funding rate yields.

Boros introduces fixed-vs-floating trading on perp funding, similar to how Pendle created fixed-rate markets for LST yields and points. Just as stETH yield became a tokenized income stream through PTs, the funding paid on 1 BTC or 1 ETH can now be traded via their proprietary Yield Units (YUs).

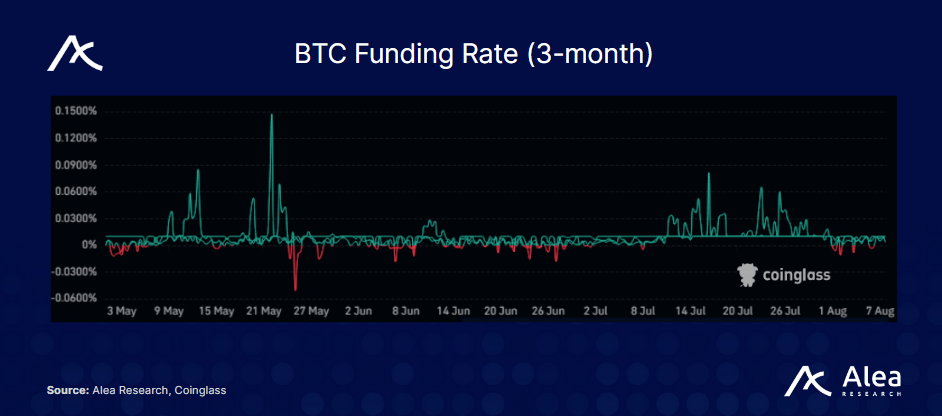

This unlocks new tools for yield speculators, but more importantly, it provides carry-exposed protocols like Ethena a way to reliably hedge funding rate exposure. Ethena’s delta-neutral strategy depends on receiving positive funding. Looking at BTC’s funding rate for example, over the past 3-months, there have been periods where funding was negative for a few days consecutively.

With Boros, it can receive a fixed funding rate to lock in predictable cash flows for its USDe stablecoin and offer consistent APRs for holders.

Boros’ Key Components & Strategies

Yield Units (YUs) is the core product of Boros. Each one represents the yield earned on 1 unit of collateral (BTC, ETH, etc.) over a given period, using an oracle (like Binance or Hyperliquid) depending on which funding rate market it uses.

Pricing is APR-denominated, with four key benchmarks:

Implied APR: Market-determined fixed rate baked into the YU trade (price of the YU).

Underlying APR: The real-time funding rate from the respective oracles.

Mark APR: Standardized PnL reference used for margining.

Liquidation APR: Threshold where insufficient margin triggers force-close (essentially the liquidation price for YUs)

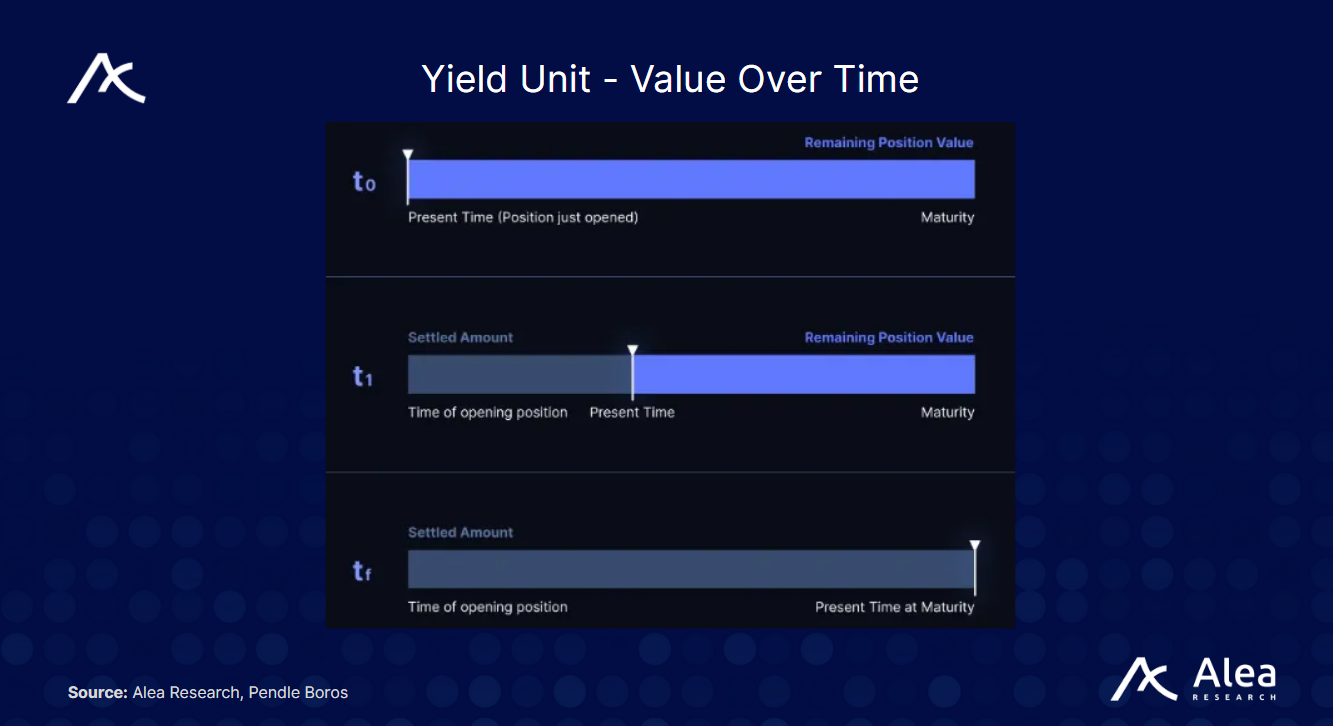

Additionally, like Pendle Yield Tokens, each YU has a maturity date for which yield is accrued up to. The system uses a linear decay model, meaning as time passes and funding settles, the YU’s remaining value drops. PnL from the funding difference is realized into the trader’s collateral balance at each interval (8h on Binance, 1h on Hyperliquid).

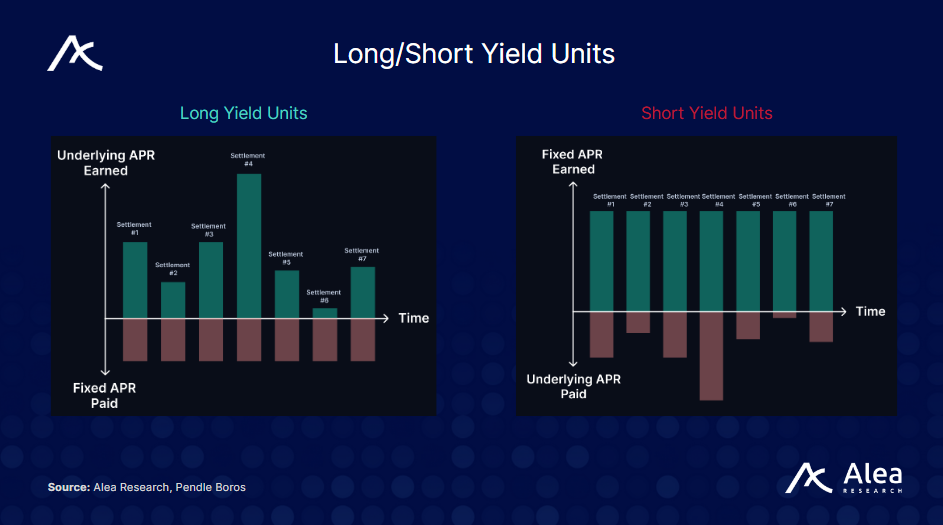

Positions require upfront collateral with conservative margining to limit tail risks as it just recently launched. The OI per market is capped at $10M and initial leverage is capped at 1.2× while progressively increasing over time as the system validates itself. This ensures that Boros can scale responsibly while still offering capital efficiency. Traders primarily interact with YUs in two directions:

Long YU: Pay a fixed (Implied) APR, receive the floating funding rate (Underlying APR). You are long future funding.

Short YU: Receive a fixed (Implied) APR, pay the floating funding rate (Underlying APR). You are short future funding.

Common strategies that can be paired with YUs often involve funding rate hedging.

Hedge Funding Fluctuation: 10 ETH Long paying 50% APR in funding. In this instance, traders could look to long YUs to pay the fixed rate of 50%. The floating underlying rate is hedged by the original position, effectively removing exposure to funding rate fluctuations.

Lock in Fixed Yield: 10 ETH Long Getting paid 50% APR in funding. In this instance, traders could look to short YUs to receive fixed 50% APR funding payments. The floating underlying rate is similarly hedged, giving the trader net consistent 50% payments until maturity.

Delta-hedging: Suppose you're delta-neutral, long spot ETH and short ETH-PERP. If funding is highly positive, you're collecting a strong but potentially unpredictable yield. Going short YU lets you lock in that yield, converting a volatile floating APR into a fixed APR. This is valuable for protocols like Ethena.

How Boros Markets Work: Orderbooks and Vaults

Boros lets users trade funding-rate yield through an orderbook and through vaults. Each serves a different type of trader or investor.

Orderbook: Provides high-precision APR quoting and fills, useful for active traders especially sophisticated DeFi users or institutional desks. For example, if you're confident funding rates will rise or fall in the near future, you can place a bet at a specific rate. This is especially useful for funds or market makers who have a view on short-term funding trends and want tight control over specific entry and exit prices.

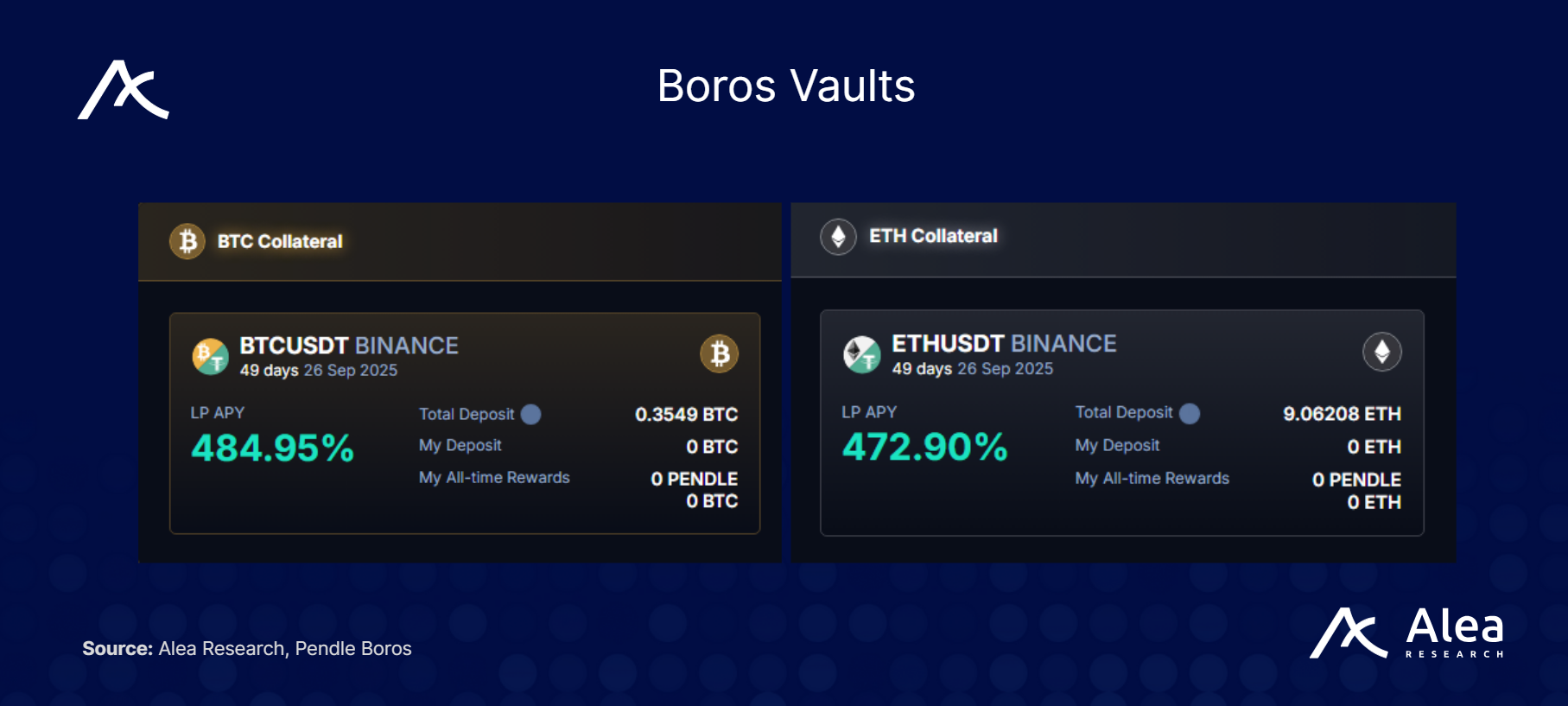

Vaults: Act as AMMs for YUs, offering passive exposure to funding markets, swap fees, and $PENDLE incentives. These mimic a 50/50 setup like how Uniswap LP positions work, but instead the 50/50 is made up of a long YU leg + base collateral position (e.g. long 5 YU-ETHUSDT + 5 ETH).

The $PENDLE Economy

New revenue, new vault demand, new reasons to lock $vePENDLE.

Boros introduces new fee streams:

Swap fees (for YU trading)

Settlement fees (from the fixed vs. float PnL)

Vault LP fees + incentives

These flow into Pendle’s protocol revenue and boost APY for $vePENDLE lockers. As governance routes more incentives to Boros markets, it draws in more traders and LPs which in turn expands open interest and increases fee generation. It also encourages TVL migration from CEXs and DEXs, especially from passive capital seeking non-directional funding yield that did traditional basis trading on an exchange (or exchanges).

In terms of product scope, Pendle now supports staking, points, and funding rate yield markets under a single umbrella. This deepens its moat, increases its surface area for integrations, and pushes it closer to becoming the default fixed-income leg for DeFi.