The rise of livestreaming has transformed content from a pastime into a high‑leverage market. Unlike a traditional job where one hour of work yields a set return, streaming multiplies that hour by the number of viewers watching. A single hour can generate thousands of viewer‑hours of attention which is an asset that advertisers, platforms and creators can monetize. Yet, creator income remains highly skewed.

On Twitch and YouTube, revenue comes primarily from subscriptions and ads, and tiered revenue splits mean the average streamer keeps just 50% of their subscription revenue, while top creators rake in >10x more. New entrants like Kick flipped this model by letting streamers keep 95% of subscription income, sparking a “Kick‑vs‑Twitch” arms race and multimillion‑dollar signing deals.

Into this landscape steps Pump.fun, the platform best known for launching memecoins. In mid‑2025 it quietly added livestreaming with a dynamic fee model that ties streamer income to the performance of their own tokens.

In this edition, we’ll discover how Pump.fun’s creator capital markets work, why they matter in the battle against Kick and Twitch, and why tokenize streaming.

Stay informed in the markets ⬇️

The Status Quo: Kick vs. Twitch

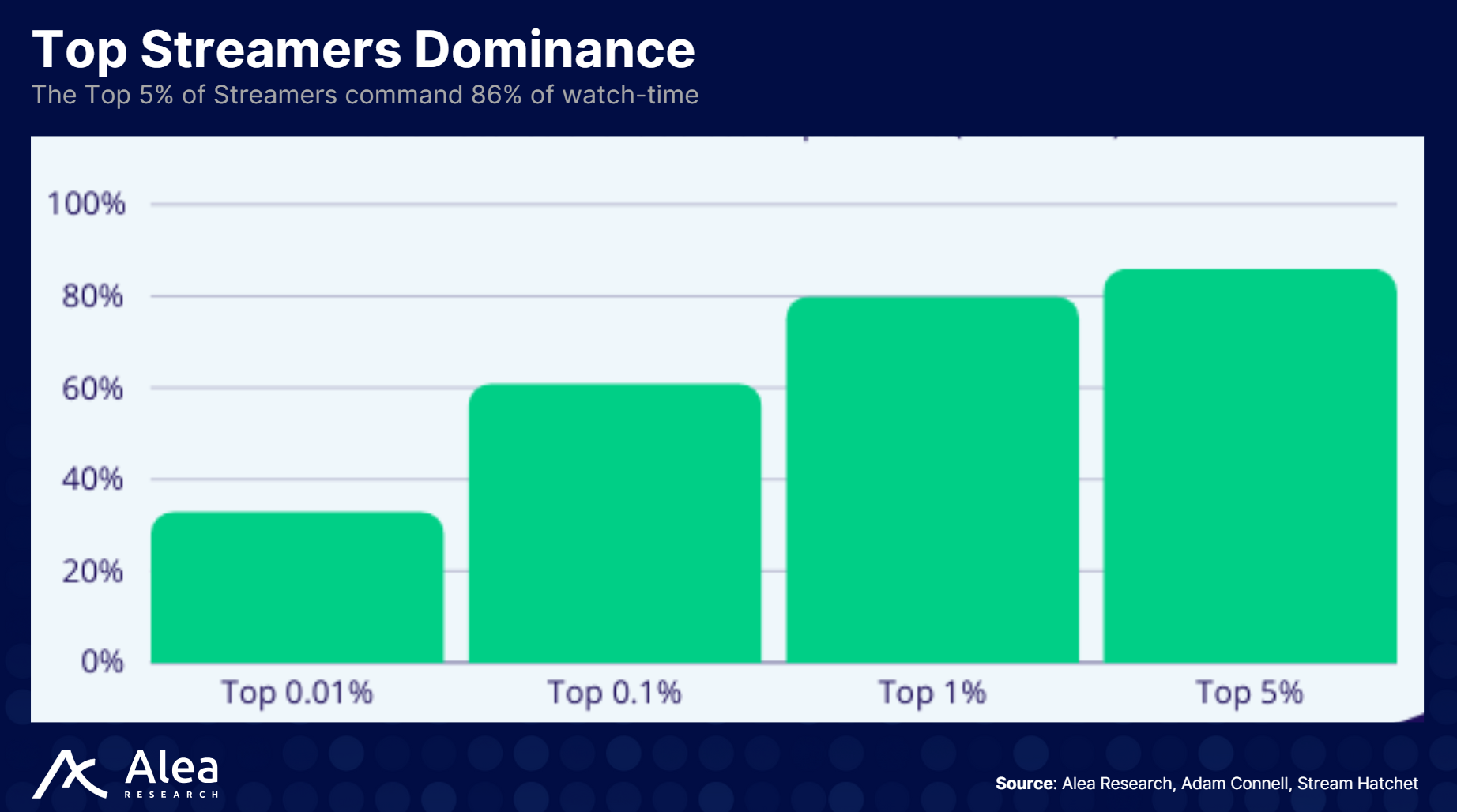

Twitch pioneered livestreaming boasting an average 1.5B hours in monthly watch time. The standard revenue share for most streamers is a 50/50 split with Twitch for subscriptions and a 55/45 split for ads via the Ads Incentive Program (AIP). Top-tier streamers with a Partner Plus Program Level can earn a more favorable 70/30 split on subscriptions. This creates pareto dynamic where top creators earn 80% of the watchtime/revenue while smaller creators battle out for the 20%.

For example, Kai Cenat is the number 1 streamer on Twitch with almost more active subs and earnings than the 2nd to 10th top streamer combined.

Kick, launched in 2022 with backing from gambling platform Stake.com, challenged this by promising streamers 95% of subscription revenue and allowing content like gambling that Twitch restricts. Kick also signed high profile contract with top Twitch streamers for them to migrate over. They reportedly offered top Twitch star xQc a two‑year, $100 million non‑exclusive deal, while also signing Amouranth for around $30–40 million.

Between these announcements, Kick added over a million new users. These moves illustrate that streaming platforms are willing to spend heavily for attention, but revenue still comes from subscriptions, ads, and donations.

Thematic Context – Attention Economics and Pareto Dynamics

There is a common misconception that livestreaming is a zero-sum game as more streamers enter and rewards/watch-time gets diluted. Attention follows a Pareto distribution, where a handful of viral creators command outsized audience share while most struggle. When a top creator like Kai Cenat or iShowSpeed goes live, they expand the total pool of viewers where millions of fans who might never use a new platform sign up to watch them.

This phenomenon explains why Kick pays huge signing fees: importing attention capital grows the entire ecosystem rather than cannibalizing existing streamers’ audiences.

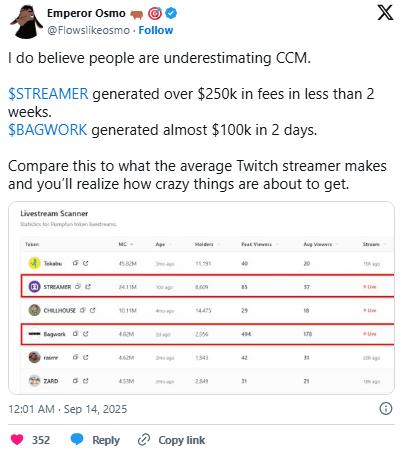

On pumpfun, traditional Twitch streamers are already making the move (e.g. League of Legends streamer BunnyFuFuu):

Pump.fun aims to achieve this dynamic by letting fans import their spending power via tokens. Hardcore viewers already budget monthly donations, but buying a streamer’s coin simply channels that spending into a tradable asset. Holders are incentivized to promote the streamer (driving price appreciation), and if the creator goes viral, early supporters share the upside. In this sense, streamer tokens convert donations into a stake which aligns fan incentives with a creator’s success and potentially mitigating feelings of “dilution” when new streamers join.

Enter Creator Capital Markets

Pump.fun’s livestream pivot introduces an entirely different economic model: streamer tokens. Instead of (or alongside) tipping or subscribing, viewers buy a token tied to a specific streamer. The value of this token fluctuates with supply and demand, creating an investment‑like mechanism where fans can speculate on a creator’s popularity.

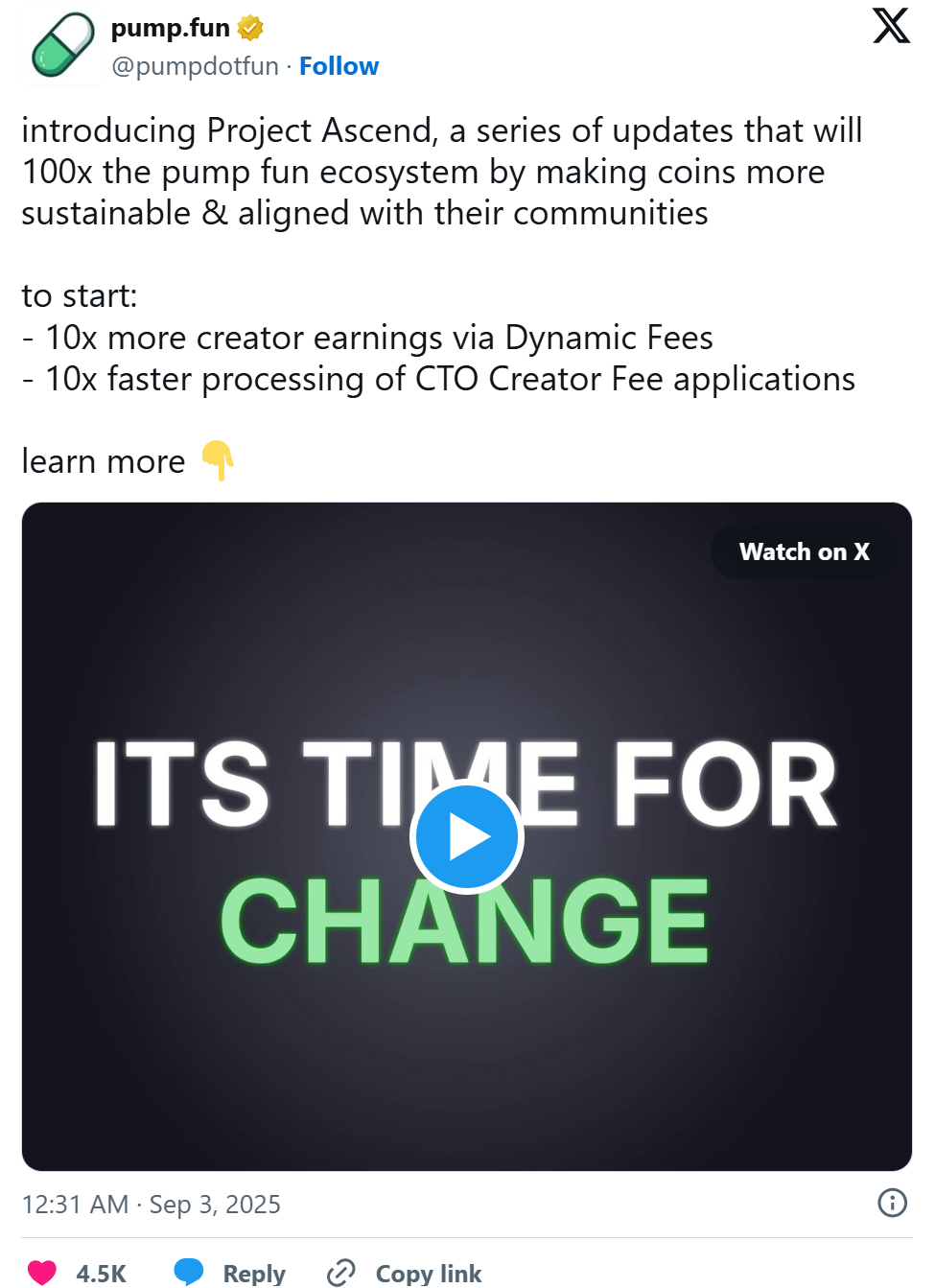

Streamers earn a fee on every trade of their token (up to 0.95% for smaller projects under Project Ascend), which naturally declines to 0.05% as the token’s market cap grows.

Pump.fun has also reopened streaming to a subset of users with improved content moderation banning violence and animal abuse, but the key innovation is this tokenized feedback loop linking fan engagement and creator income.

Pump.fun’s tokenized streaming model

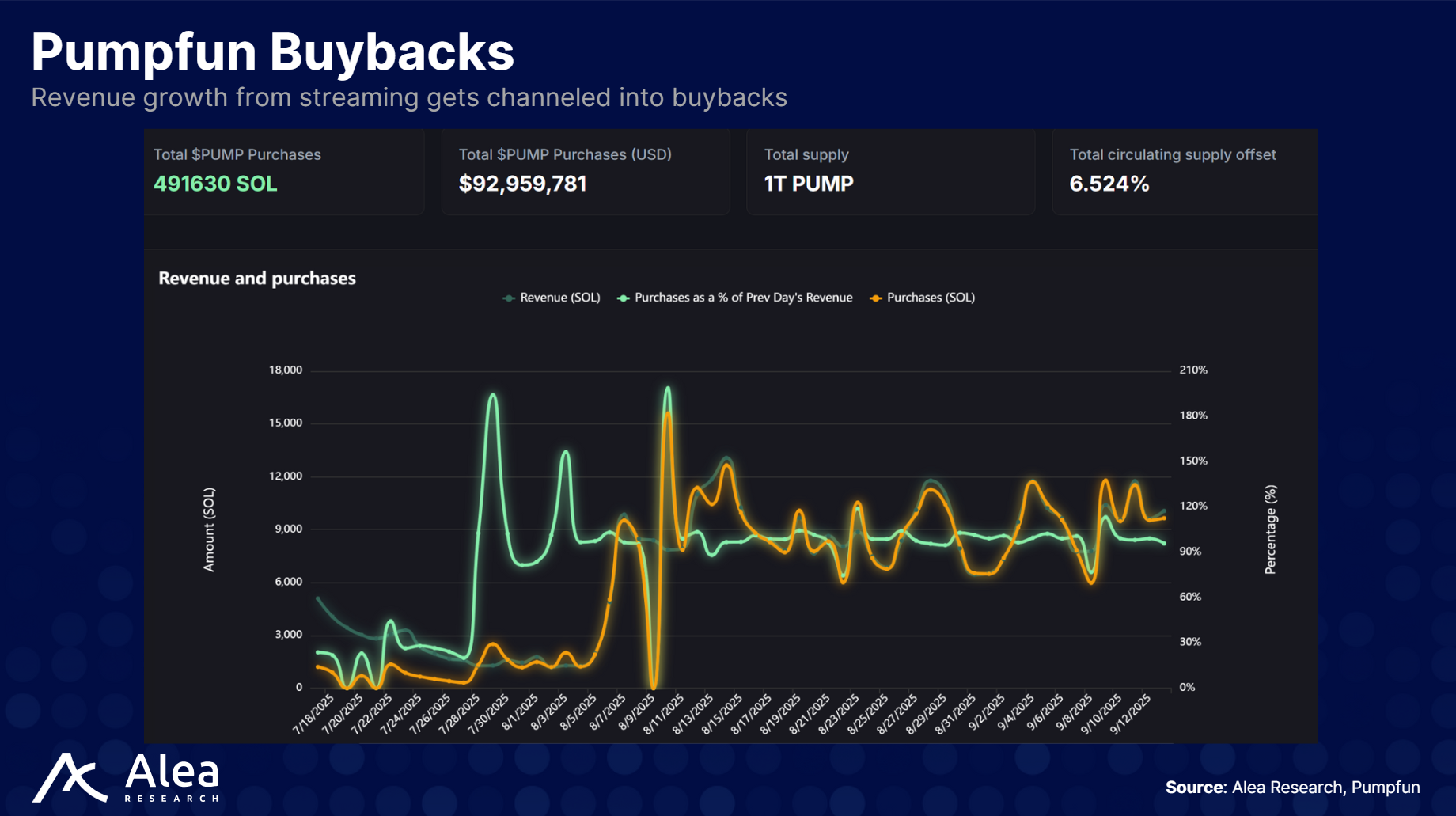

Project Ascend replaced Pump.fun’s flat 0.05% creator fee with a sliding scale ranging from 0.95% for tokens under $300k market cap to 0.05% for those over $20 million. This rewards small creators by letting them earn almost 1% of every trade in their token. According to Blockworks, the update helped Pump.fun regain market share, generating over $834 million in total revenue with an annualized run rate near $492 million, and spurring daily buybacks that exceed $68 million.

After halting livestreams due to harmful stunts, Pump.fun relaunched streaming for 5% of users with stricter guidelines: violence, animal abuse, and hate speech are banned. The platform expects some NSFW content but is trying to maintain a baseline of safety while still allowing edgy entertainment. This is crucial for mainstream adoption and for avoiding the fiascos that plagued its first attempt.

Viewers can buy or sell streamer tokens permissionlessly where no single entity controls the liquidity. The ability to go long or short on a streamer’s coin adds depth to the market and provides price signals about community sentiment. A token tied to a creator’s performance also incentivizes consistent streaming schedules and community engagement.

Why choose Pump.fun over Twitch/Kick?

Monetary incentives – On Twitch or Kick, fans donate or subscribe with no financial return; on Pump.fun, donations become an asset. If the streamer gains popularity, the coin may appreciate, offering speculative upside to early supporters.

Creator earnings scale with success – A streamer’s income isn’t capped by a flat subscription fee. They earn fees on token volume and can benefit from network effects as more traders join. Pump.fun’s dynamic fee model means small creators can earn up to 19× more per trade than under the old flat‑fee system.

Community ownership – Streamers and viewers share economic incentives. This may encourage more collaborative content, such as shared quests or community decisions about future streams.

Closing Thoughts

Pump.fun bets that tokenized streamer fanbases can unlock a bigger pie of attention and donations by letting fans share in the upside. Whether it can repeat Kick’s early traction depends on its ability to lure top talent, maintain robust moderation, and scale its dynamic fee model.

But if the experiment succeeds, it could create a new paradigm for creator economies where streaming, trading, and speculation converge.