Stellar focused on enabling fast, low‑cost, and interoperable value transfer between traditional money and digital assets. Today, this mission is colliding with a global surge in stablecoins that promise the speed of crypto with the stability of fiat.

With regulatory clarity emerging under US’s GENIUS Act, Europe’s MiCA and new corporate entrants, stablecoins are becoming mainstream. Stellar’s unique architecture and established ramp network position it at the center of this transformation.

In this edition, we’ll explore why stablecoins matter now, Stellar’s recent institutional partnerships, RWA integrations, and more.

Stay informed in the markets ⬇️

Stellar’s Role in Cross‑Border Finance

Stellar is an open‑source L1 optimized for payments boasting confirmation times of 3–5 seconds, with average fees of $0.000005 per operation, making it one of the fastest and cheapest settlement networks available and hence ideal for stablecoins.

It supports built‑in asset controls such as KYC, freeze, clawbacks and offers native functionality for issuers to mint and manage assets. These features have made Stellar the backbone for numerous fiat‑backed stablecoins, including USDC, EURC, GYEN, AUDD, and ZUSD.

Through partnerships with on and off‑ramps like MoneyGram, users can easily move between digital dollars and local cash without needing a bank account.

Rise of RWA & Stablecoins

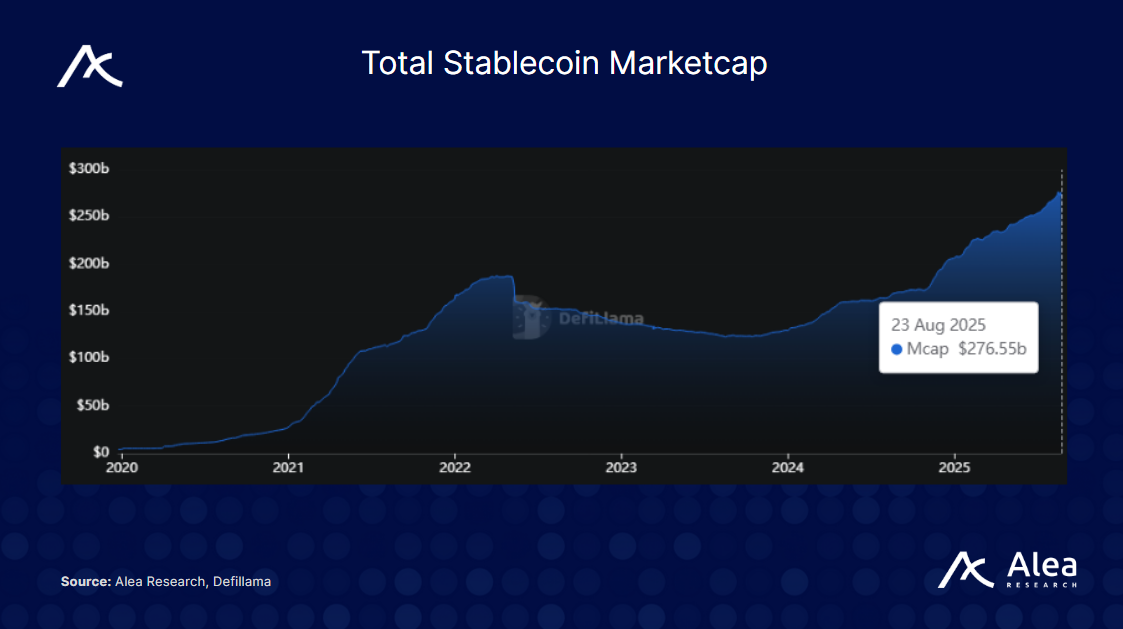

Stablecoins are widely viewed as crypto’s primary adoption use-case as they bridge digital finance with fiat stability. Stablecoin total marketcaps are are all-time-highs of $276 billion.

At the same time, the regulatory landscape is maturing. US’s GENIIUS Act and Europe’s Markets in Crypto Assets (MiCA) regime provides a framework for compliant stablecoins, encouraging banks and regulated issuers to launch digital dollars or other fiat‑backed tokens.

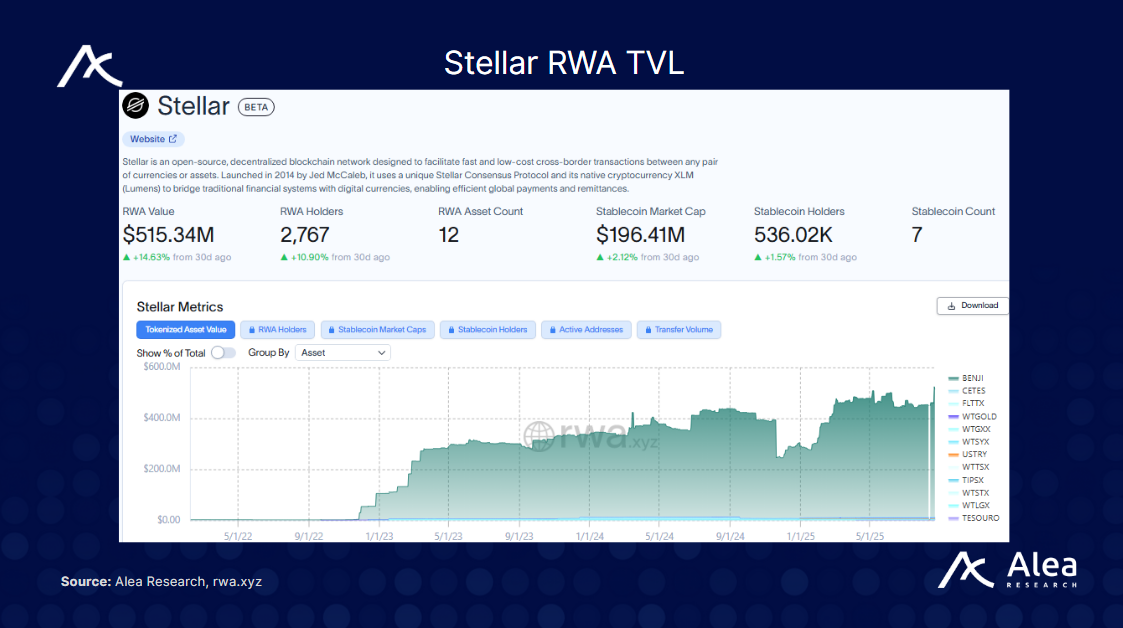

Stellar is also expanding in tokenized real‑world assets (RWAs). The network already ranks second in tokenized treasuries with over $500 million in RWAs. $1.5T AUM asset manager Franklin Templeton’s $BENJI money market fund which accounts for majority of the TVL.

Additionally, new integrations with Taurus‑PROTECT (a custody platform), Taurus‑Capital and Paxos will allow banks and issuers to tokenise assets on Stellar. These developments paves the road where users can hold yield‑bearing US treasuries, tokenized gold or other RWAs alongside stablecoins, combining cash‑like utility with the potential for capital growth.

Soroban and the Move Toward DeFi & RWAs

Stellar’s 2024 Year in Review highlighted major technical milestones. The network launched Soroban, a smart‑contract platform that allows developers to build decentralized applications while maintaining Stellar’s speed and cost advantages.

Projects like the modular liquidity protocol Blend currently sits at $32 million TVL. The network’s 2025 roadmap aims to scale TVL to $1.5 billion and rank among the top 10 DeFi chains (currently ranked 37).

At the Meridian conference in October 2024, Paxos announced it would integrate with the Stellar network, bringing its tokenization platform to Stellar and expanding the network’s reach and furthering its institutional adoption. The partnership underscores Stellar’s growing appeal as a trusted, compliant blockchain for asset issuance and settlement.

Additional 2024/2025 highlights include:

Mastercard Crypto Credential partnership: Stellar joined Mastercard’s credential system, enabling secure, compliant crypto transactions and improving user experience.

Stripe payouts on Stellar: U.S. merchants can now pay via crypto using Stripe’s integration, with crypto pay‑ins coming soon.

Yellow Card integration: Africa’s largest licensed on/off‑ramp introduced USDC on Stellar, offering digital dollar payments in 20 African countries.

Franklin Templeton’s Benji and other RWAs: Continued growth in tokenized treasuries and other yield‑bearing assets highlight the network’s capability to support regulated financial products.

These developments set the stage for Stellar’s upcoming Meridian Conference 2025 in October: