Telegram is quietly becoming the most valuable distribution layer in crypto. With over 1 billion users and a fast-growing ecosystem of native MiniApps, Telegram has evolved from a messaging platform into a full-stack consumer operating system. But until now, their DeFi footprint has been marginal, largely limited to marketing, speculation, and community management.

The infrastructure to turn Telegram into an on-chain economic engine didn’t exist.

TAC Build aims to solve this by embedding an EVM-compatible chain directly into The Open Network (TON), tightly integrated with Telegram-native UX. Following its mainnet launch and TGE, TAC now enters full production with $TAC utility live, a deep roster of partner protocols, and over $800M in pre-launch liquidity.

In this edition, we cover TAC’s core value proposition, their Mainnet launch, $TAC token utility, and more…

Stay informed in the markets ⬇

Bringing Ethereum to Telegram: TAC’s Core Infrastructure

TON is rapidly emerging as the most active L1 ecosystem by user count, thanks to Telegram’s built-in distribution and mini-app framework. With over 1 billion monthly active users and a native Web3 wallet, Telegram is positioned to be the largest consumer-to-DeFi funnel.

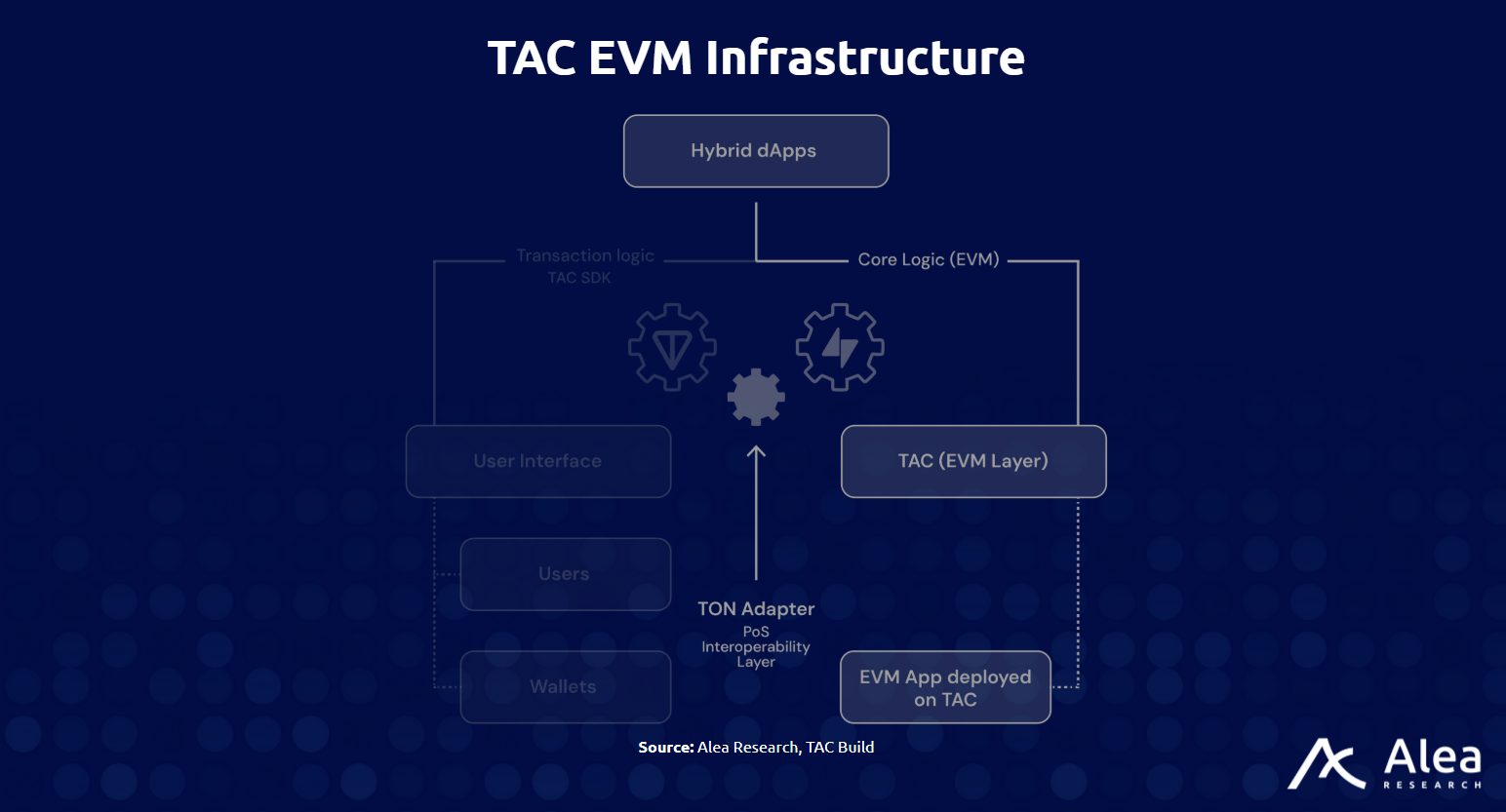

Built on Cosmos SDK and Ethermint, TAC leverages dPoS for consensus and plans to integrate Babylon’s Bitcoin restaking module for additional security. The result is a low-latency, institution-grade execution environment that connects Ethereum DeFi logic with Telegram’s massive distribution layer. This unlocks use cases from swaps and lending to yield strategies, prediction markets, and more.

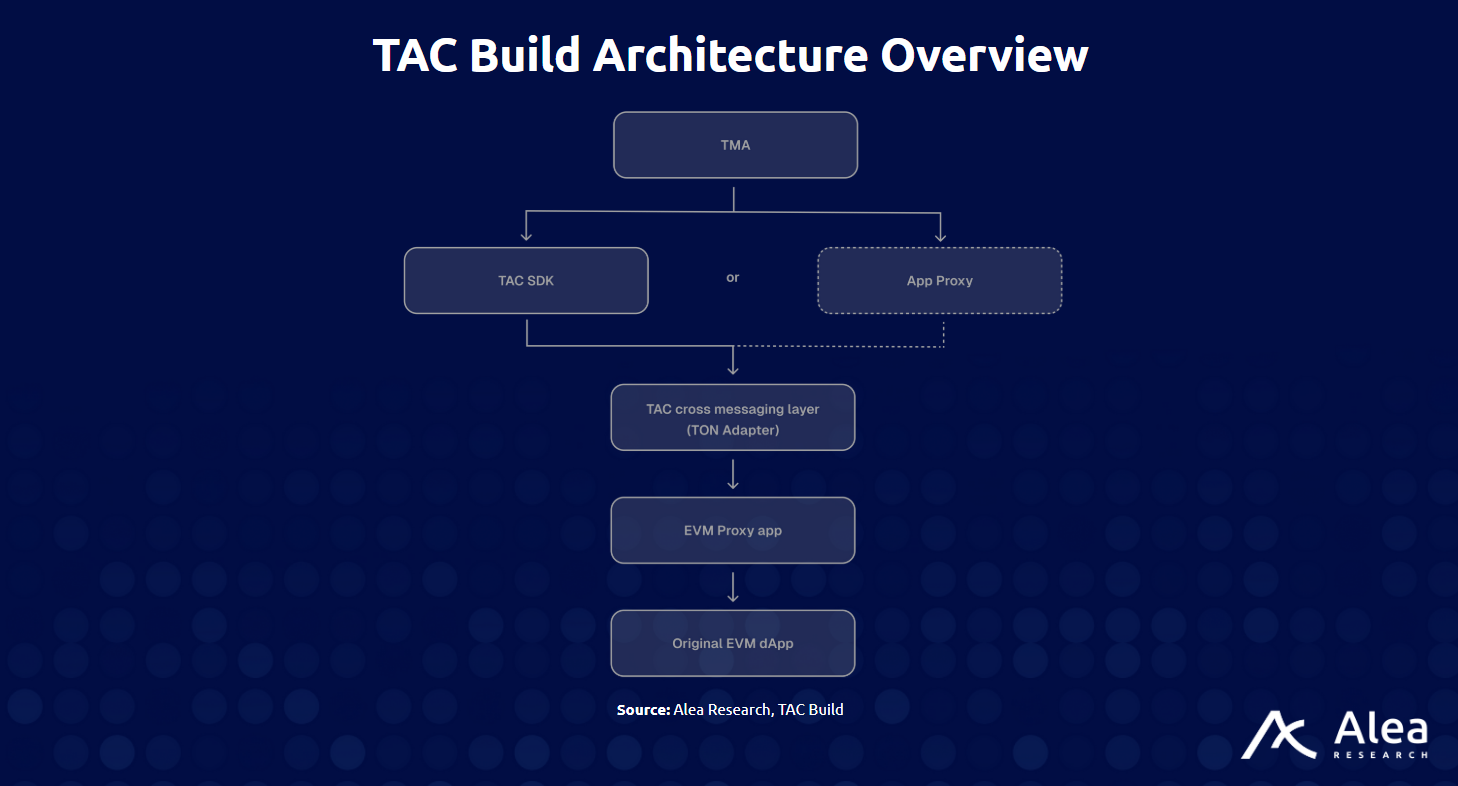

At the heart of this integration is the TON Adapter, a middleware bridge that abstracts away token standards and routes transactions between TON-native assets and the TAC EVM. This allows Jettons (TON tokens) to be wrapped into ERC-20 interfaces for smart contract compatibility, and user signatures from TON wallets to execute transactions within TAC’s EVM environment without friction or wallet switching.

TAC is a purpose-built Layer-1 that enables seamless deployment of Solidity-based dApps into the Telegram ecosystem via TON. Developers retain standard EVM tooling like Hardhat, web3 libraries, ERC interfaces, while users engage through Telegram-native MiniApps and TON wallets.

Mainnet Launch: Full-Scale DeFi Infrastructure Embedded in Telegram

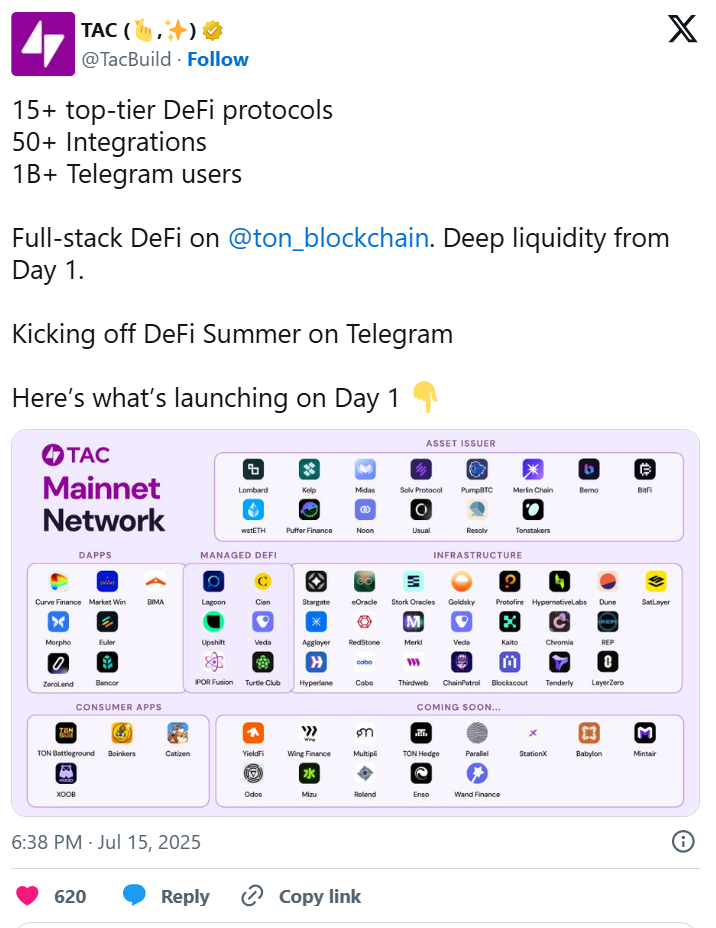

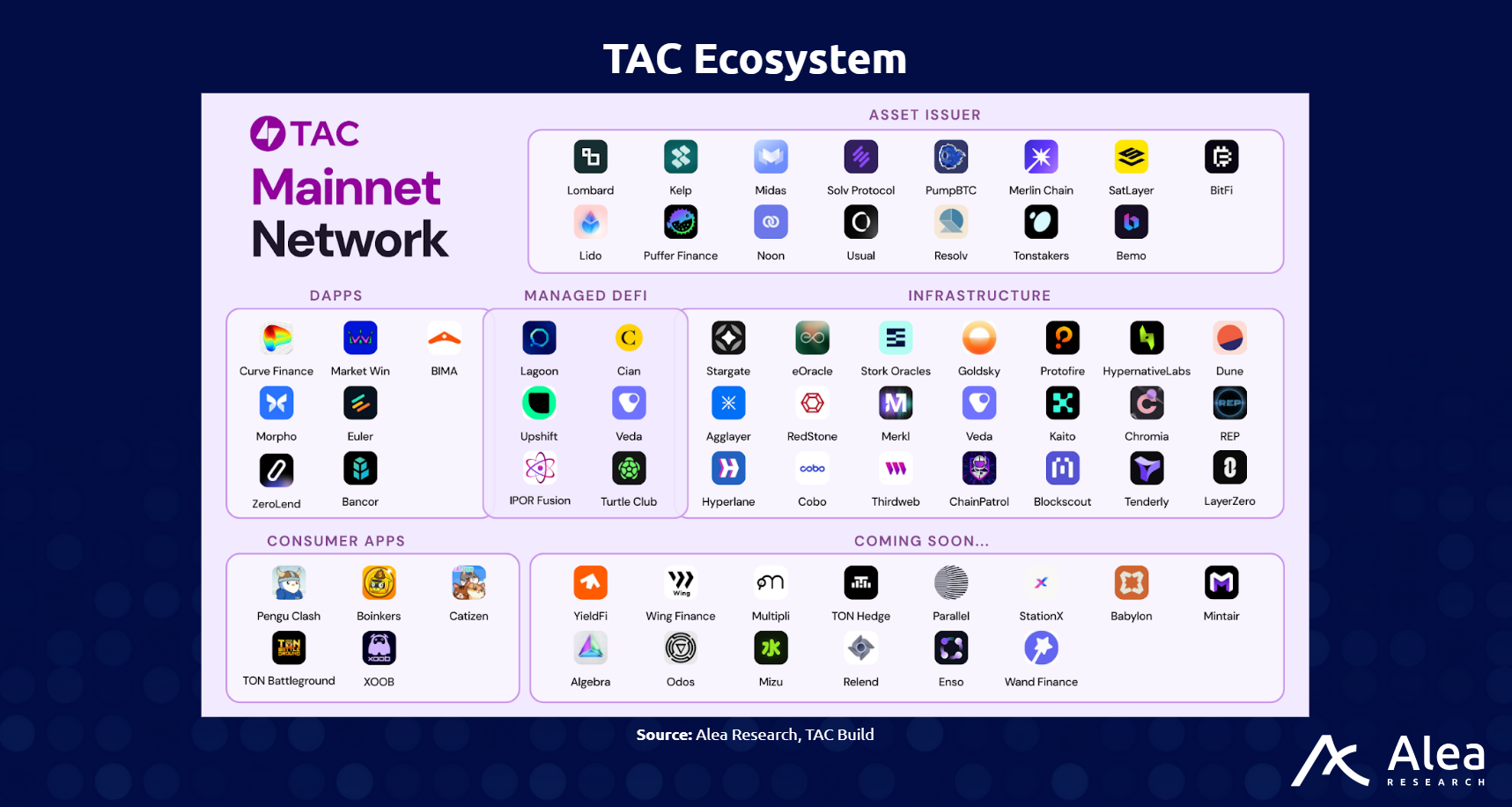

TAC’s mainnet went live on July 15, supported by over $800M in TVL committed during its “Summoning Campaign”, a pre-launch liquidity initiative designed to ensure that TAC’s DeFi stack launched fully capitalized.

Major protocols including Curve, Morpho, Euler, and Zerolend are now live, with additional partners like Odos, Enso, CryptoAlgebra, BimaBTC, Wing Finance, and Mizu Finance onboarding.

TAC’s infrastructure is fully production-ready: validator decentralization is live with support from Chorus One, Kiln, P2P, and more. Bridge infrastructure is secured through canonical L1-style lock-and-mint logic, not liquidity pools. Security audits have also been completed by Halborn, Trail of Bits, and Quantstamp. Combined with integration of dev tools like Tenderly, Safe, RedStone, LayerZero, and Goldsky, TAC offers a complete, battle-tested execution layer from day one.

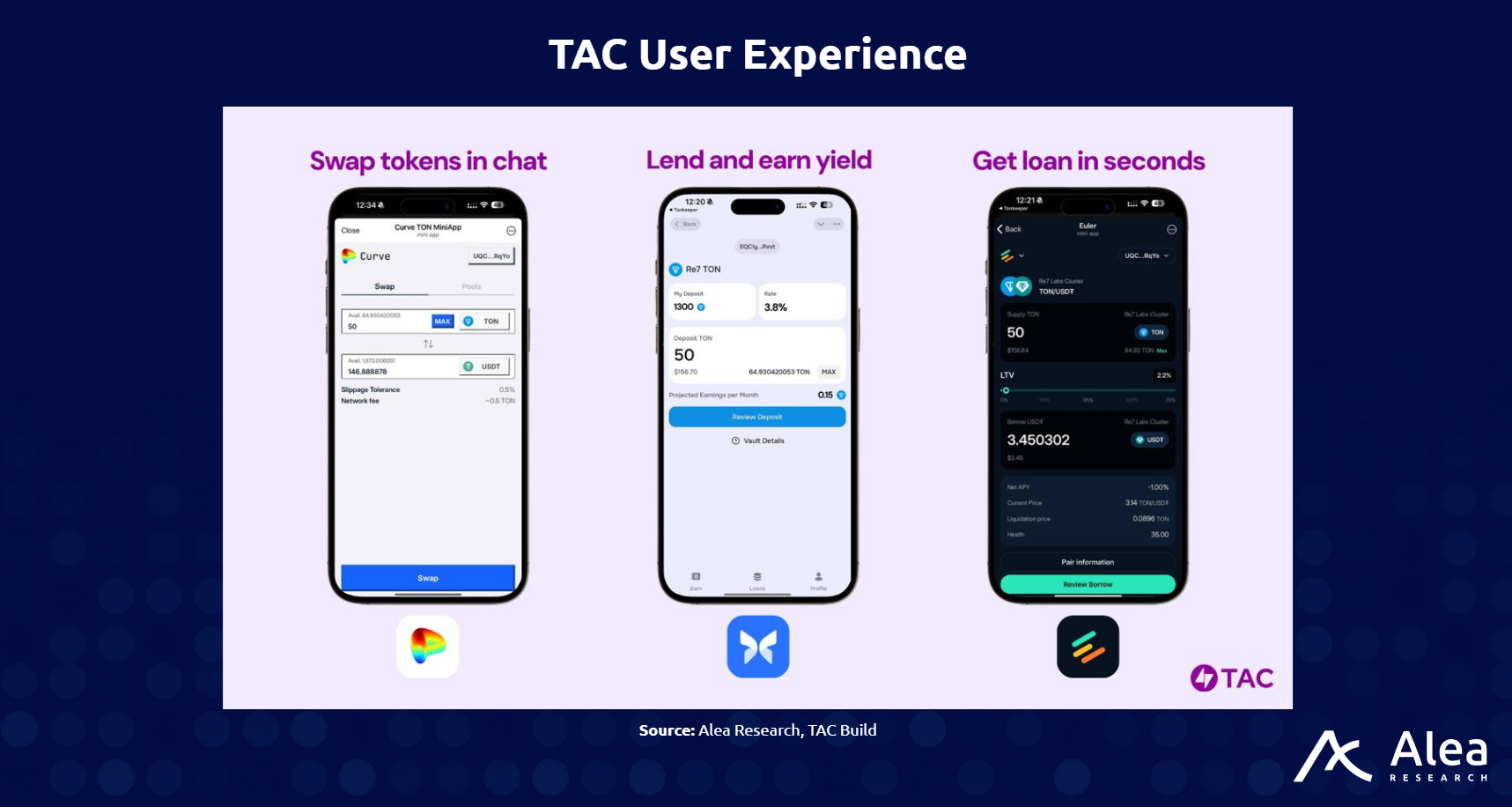

These protocols now operate natively within Telegram MiniApps, enabling swaps, lending, and automated strategies directly inside messaging interfaces, without browser extensions or wallet switching. Developers gain access to a full-stack EVM, while users gain access to sophisticated financial tools via interfaces they already understand.

The $TAC Token

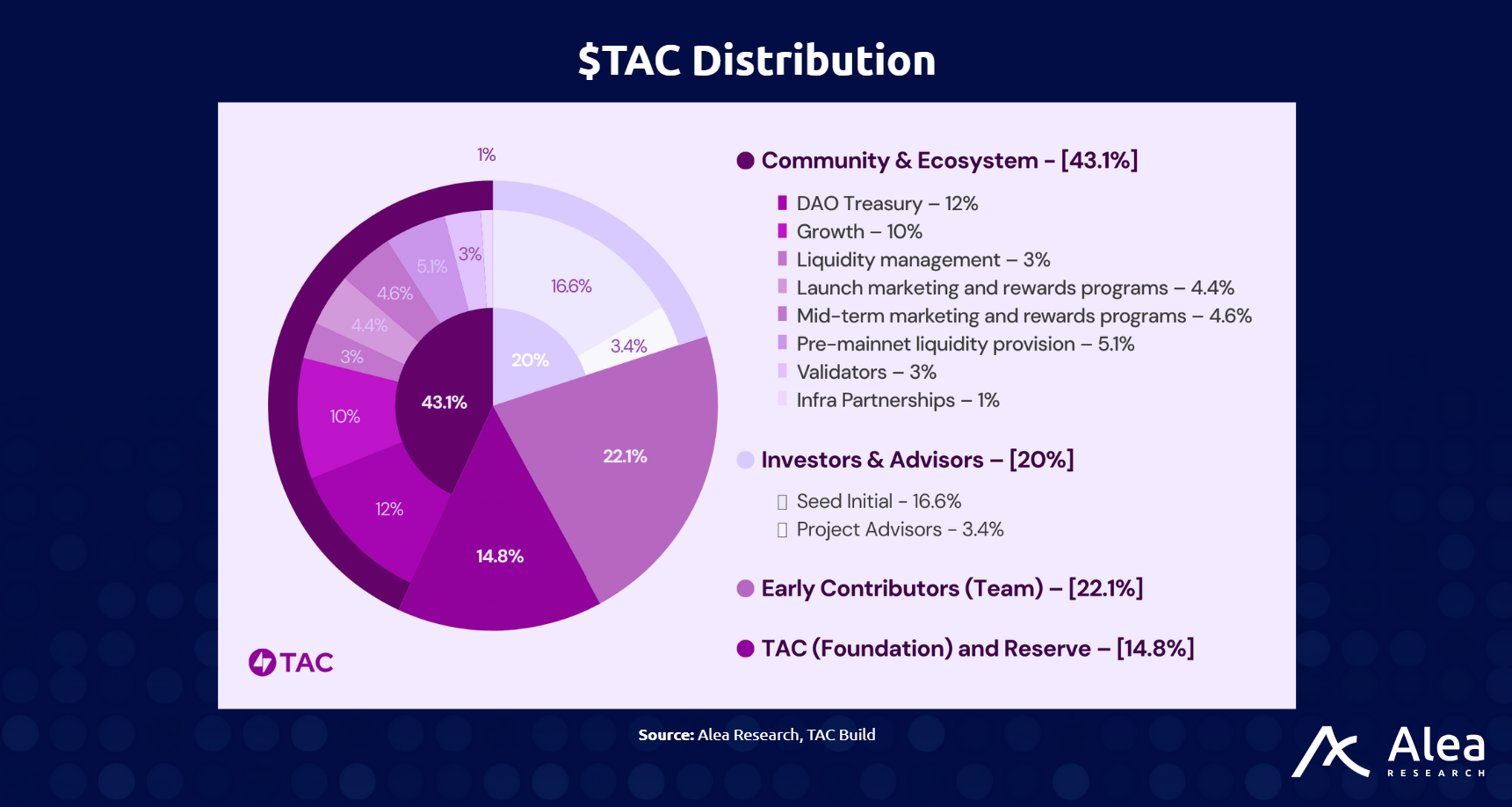

The $TAC token is the native asset of the TAC protocol, powering every layer of activity across the network. The total supply is 10 billion. At launch, 18% of the 10B supply is in circulation, with over 43% allocated to community growth, ecosystem incentives, and validator bootstrapping. Investor and team allocations are subject to long lockups and linear vesting. DeFi-native utility such as LSTs, lending/borrowing, LP incentives, and vault integrations are also live or in progress.

Its utility spans three critical roles:

Gas token: All transactions and contract executions on the TAC EVM consume $TAC. TON users interacting through Telegram pay gas in $TON, but a portion of those fees is used to buy and burn $TAC in the background, creating indirect but continuous buy pressure.

Staking asset: TAC operates a delegated Proof-of-Stake system secured by $TAC. Validators stake $TAC to participate in consensus, while delegators can earn a share of fees and emissions. The protocol targets a staking yield of 8–10% APY with max annual inflation capped at 5%, and effective inflation modeled closer to 2% through reward burns on locked insider stakes.

Governance token: $TAC holders control key protocol decisions including DAO treasury usage, incentive programs, future upgrades, and inflation parameters. 12% of supply is allocated to the DAO treasury, vesting over 36 months. Governance will gradually transition control of ecosystem funds and future network direction to the community.

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with TAC Build as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.