DeFi liquidity is fragmented and expensive. Tokens, vaults and protocols compete for deposits, yields are hidden in private channels, and capital migrates slowly as incentives change.

Turtle aims to solve this coordination failure. Launched in March 2024, Turtle is the first Distribution Protocol that monetizes Web3 activity by tracking users’ on‑chain behaviour and routing rewards back to them. To-date, they have onboarded over 335K wallets and have boosted almost $1.6B in liquidity across various chains and protocols.

In this edition, we’ll explore how Turtle tackles incentive misalignment, its product suite (Boosted Deals, Vaults, Campaigns, Earn widgets), ecosystem integrations, and more.

Stay informed in the markets ⬇️

Introduction to Turtle

Turtle’s goal is to align incentives among liquidity providers (LPs), developers, venture capitalists, security auditors and miners. Turtle monetizes users’ on‑chain activity including the liquidity they deploy, the yield they earn, the swaps they execute, the stake they delegate and the referral codes they use. The protocol’s mission is to realign incentive structures that currently reward only aggressive yield farming or short‑term emissions.

To do this, they leverage APIs to monitor economic actions across multiple chains and protocols and funnel rewards back to participants without exposing them to additional risk or complexity. This approach creates a marketplace where distribution partners and protocols can pay to access engaged LPs, while LPs earn exclusive deals, sustainable growth and aligned incentives for the liquidity they provide.

Turtle never acts as a counterparty and never controls funds, giving LPs self‑custody at all times. This means there are no smart contracts in Turtle’s core architecture and instead, it relies on signed messages and off‑chain coordination, which reduces gas costs, counterparty risk and regulatory exposure.

Participating in Turtle

To participate, an LP simply signs a message to register with Turtle and then continues their normal activities with partner protocols. Turtle monitors these activities and credits LPs with Boosted Deals, Vault rewards or campaign points.

Boosted Deals

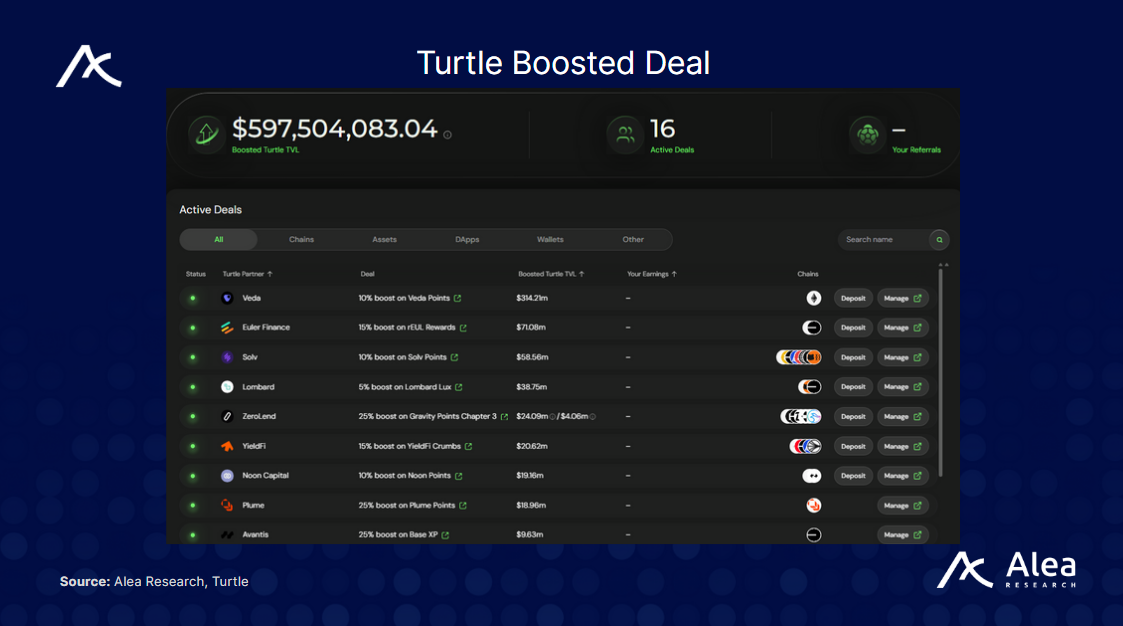

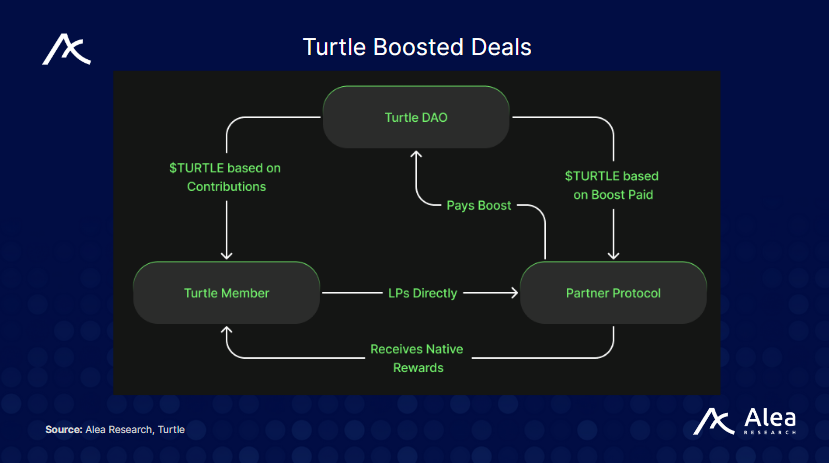

Turtle sources exclusive opportunities that offer 5%–50% additional token emissions for LPs. Current deals include those from partner protocols such as Veda (10% boost on points), Euler (15% boost on rEUL rewards), and many more. Currently, the TVL among boosted deals sit at $600M.

These extra rewards are deposited into the Turtle Treasury and later distributed to participants based on their contribution. The Boosted Deals product jump‑started the Turtle network, generating $11M in treasury value to-date.

Turtle Vaults

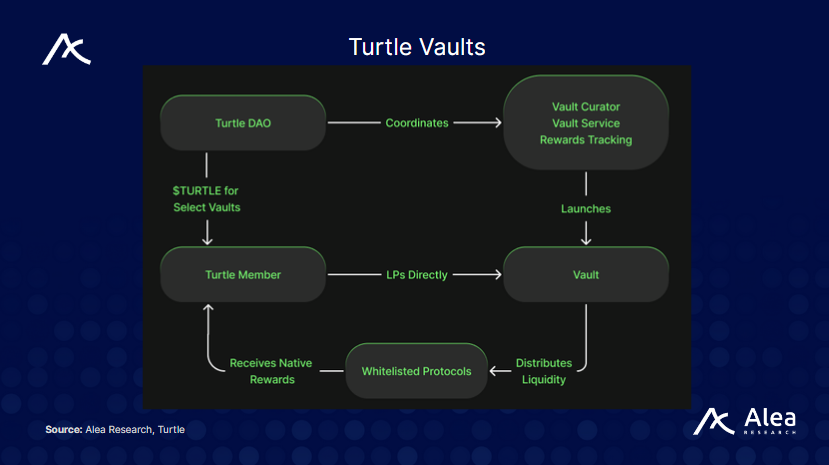

For LPs who prefer passive exposure, Turtle offers vaults that automatically rotate funds across opportunities to deliver risk‑mitigated rewards. LPs can manage positions and claims through the Turtle webapp, eliminating the need for manual rebalancing.

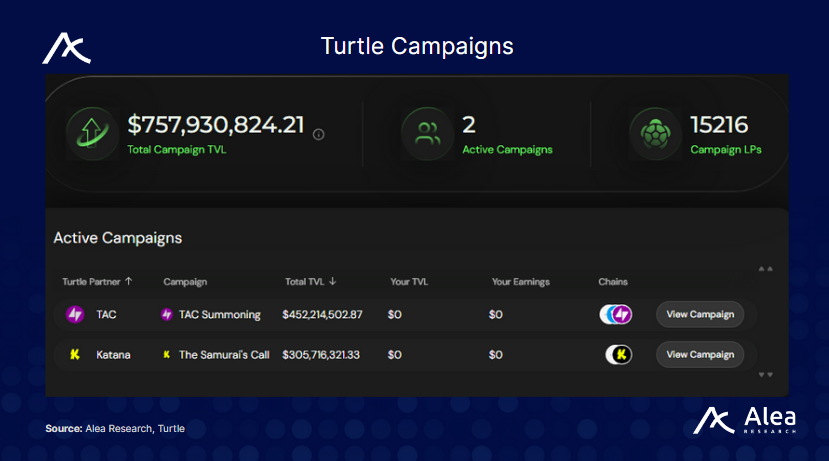

Turtle Campaigns

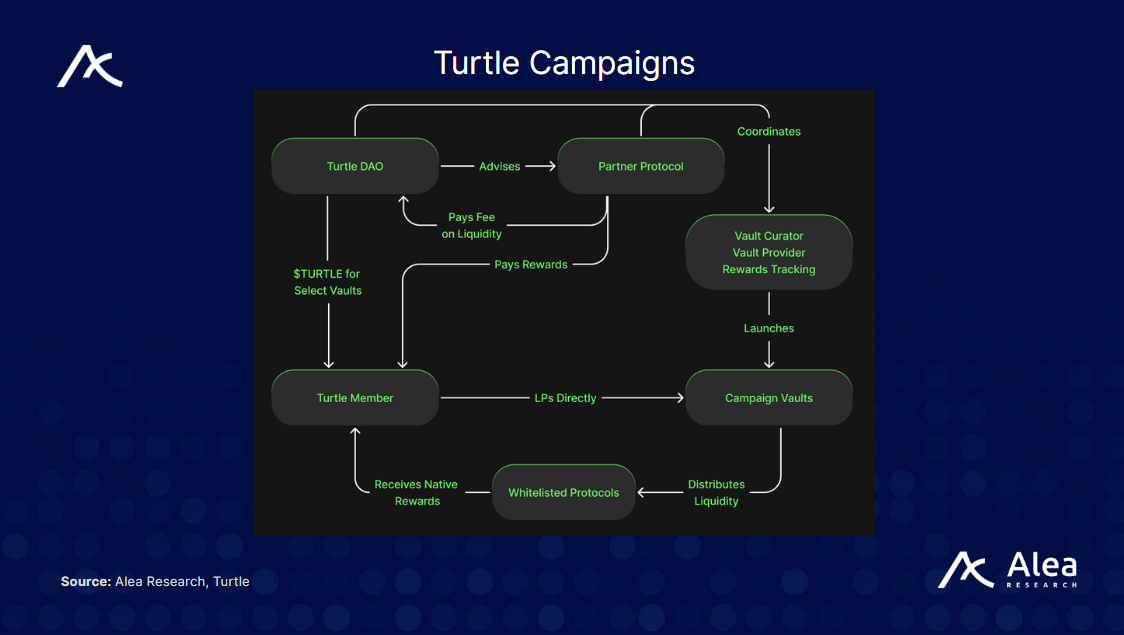

For protocols seeking to bootstrap DeFi ecosystems, Turtle coordinates large‑scale liquidity drives across vaults and reward pools.

For example, their current campaigns by Katana and TAC, attracted over $300 million and $400 million respectively demonstrating the power of targeted, cross‑protocol incentives. Campaigns are tailored to attract the right type of capital and provide structured yields for LPs.

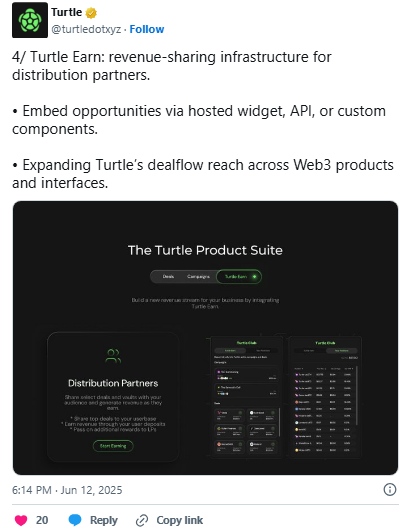

Earn Widget

For distribution partners such as wallets, DAOs, marketplaces and publishers, Turtle offers the Earn Widget. The Earn Widget is a plug‑and‑play interface that lets partners share Turtle opportunities with their users, enabling quick deployment of capital.

Turtle Earn extends this functionality through an API and component library, allowing deeper integration and revenue sharing directly into partner protocols. Partners are able to monetize their distribution channels and farm ownership in the protocol.

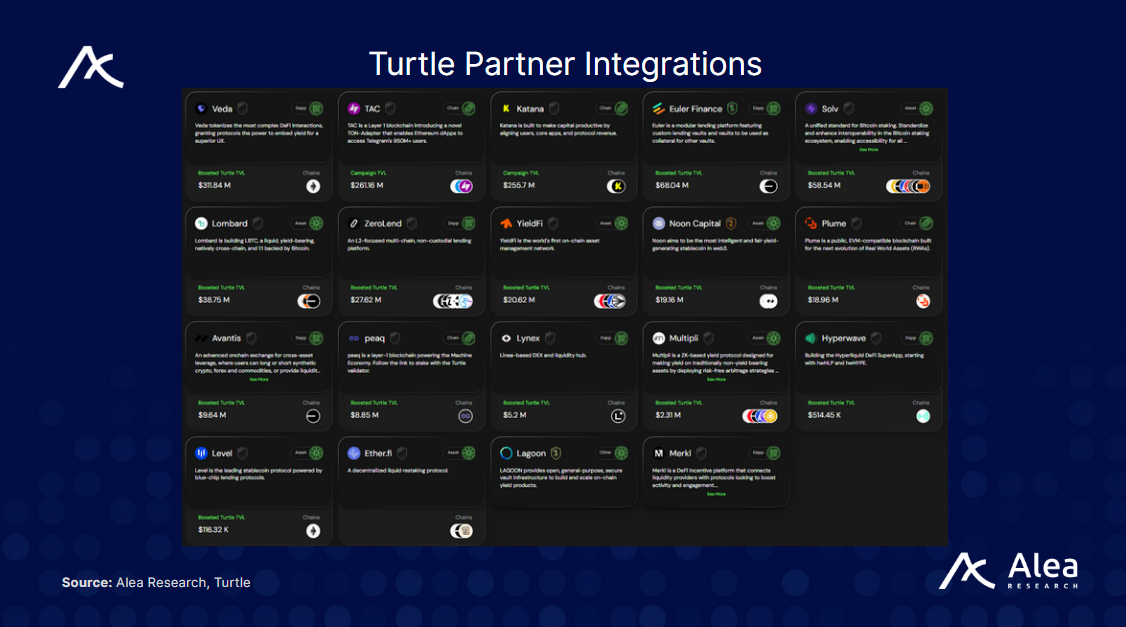

Partner Integrations

Turtle supports around 20 high quality partners to-date and is constantly expanding. The largest TVL contributors include the likes of Veda, TAC, Katana, Euler, and more.

Recent new partners include the likes of Linea, opening doors for Linea-based protocols (e.g. Lynex):

Lagoon, which will handle Katana’s Ethereum vaults:

and Plume, which will offer a special Turtle-only deal for LPs:

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with Turtle as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.