Tech giants like OpenAI, Meta and Google are buying mountains of high‑end GPUs to train and run large models, leaving startups and researchers scrambling for access.

With US export controls cutting China off from Nvidia’s most advanced chips, even the H20 which is the only AI processor legally sold into China, is facing supply shortages. In response, a GPU rental market has emerged, valued at $3.79 B in 2023, it’s projected to grow at 21.5% annually to $12.26 B by 2030 as companies choose to rent compute power rather than buying hardware outright.

USD.ai is attempting to fill this gap by offering financing for AI compute infrastructure. Unlike traditional stablecoins tied to U.S. Treasuries, USD.ai mints a synthetic dollar backed by income‑generating GPUs.

In this edition, we explore USDai’s stablecoin design, the real demand for such AI infrastructure financing, their recent deposit cap raise to $500M, and why a dollar tied to GPUs could be the “petrodollar” of today.

Stay informed in the markets ⬇️

Introduction to USD.ai’s Design

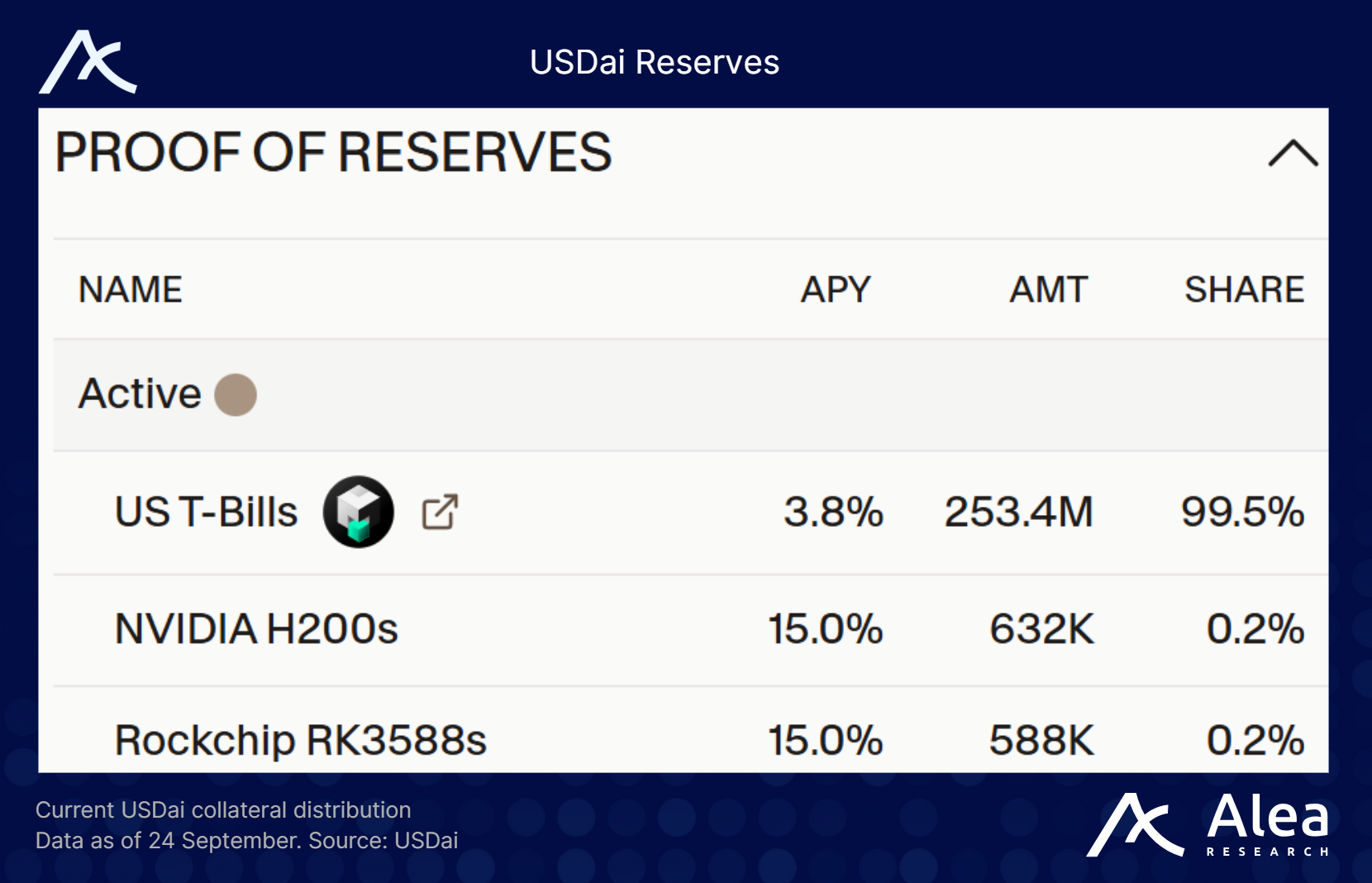

USDai tokenizes AI compute infrastructure such as GPUs and uses them as collateral for a synthetic dollar, USDai, while channeling rental payments from AI startups back to depositors.

USDai’s architecture revolves around two tokens:

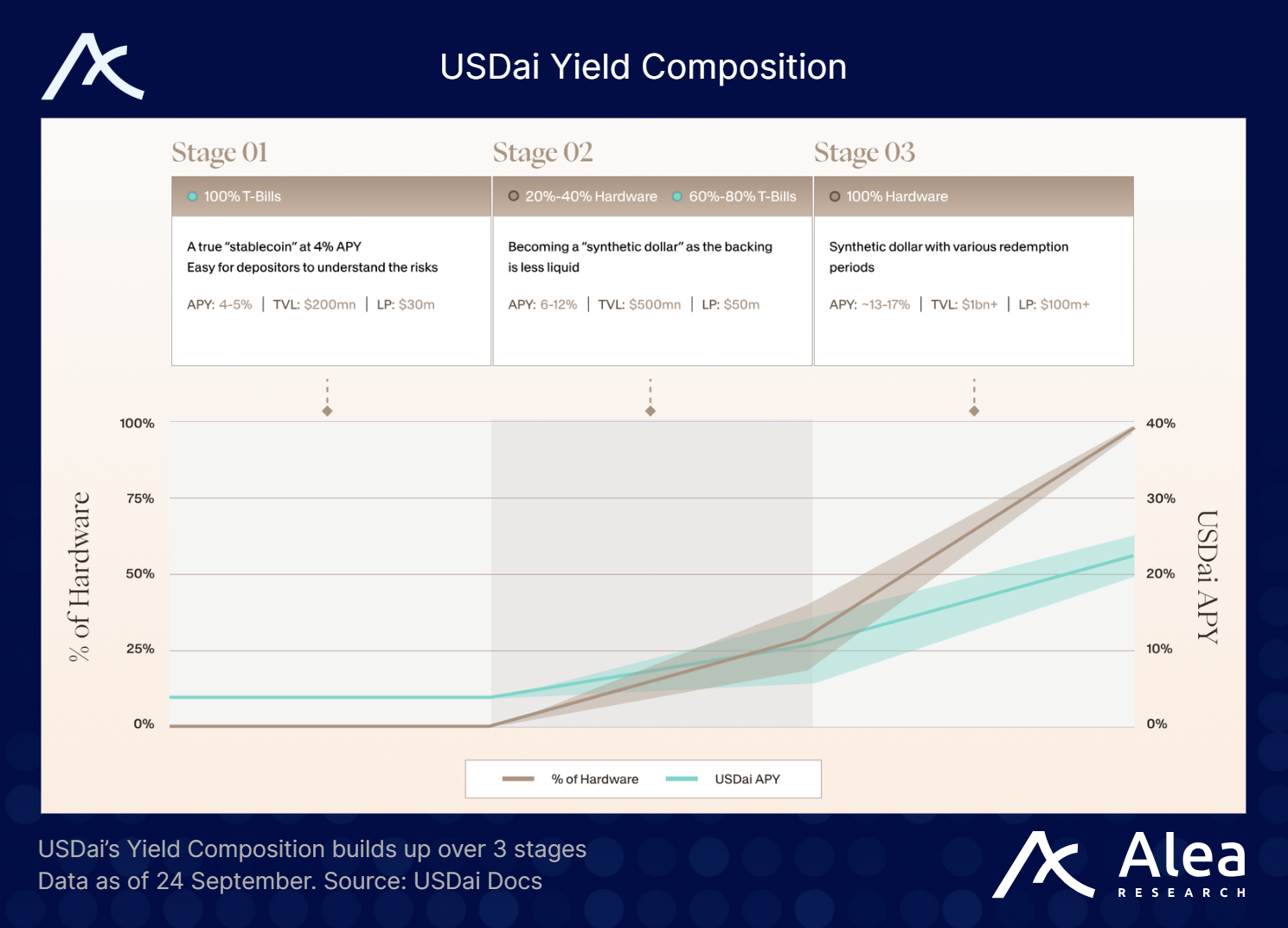

USDai - a synthetic dollar pegged 1:1 to USDC/USDT deposits. Depositors convert their stablecoins into USDai, which is fully backed by either short‑dated U.S. Treasury bills (during manufacturing lead time) or tokenized GPUs once the hardware arrives. USDai can be held or used in DeFi; there are no lock‑ups or bonding curves.

sUSDai - a staked version of USDai that earns yield. When users stake their USDai, the protocol mints sUSDai NFTs that represent claims on rental income. The yield comes from leasing GPUs and other AI hardware to non‑hyperscaler operators like Hydra Host, Lyceum, Compute Labs and TACOM.

Deposits are over‑collateralized at 70% LTV that reduce to ~40 % after a year due to its amortization system. The protocol maintains an insurance fund and first‑loss curators (FiLo) who underwrite loans and absorb initial losses. Idle capital awaiting hardware delivery is invested in T‑bills, providing baseline yield when GPUs are unavailable.

AI Compute Infrastructure Scarcity

Bain & Company notes that after the pandemic‑induced semiconductor crunch, a new shortage is looming due to AI. Data‑centre GPU demand will continue to climb if GPU demand doubles by 2026 (a plausible scenario), component suppliers would need to increase output by over 30%.

In late 2023 and early 2025, the US restricted sales of Nvidia’s most advanced chips (like A100/H100) to China. Manufacturers then introduced the H20, a downgraded chip that complies with export limits, but supply has been nearly exhausted. More recently, China outright banned major local tech companies from buying AI chips from Nvidia.

Building a GPU farm requires multi‑million‑dollar investments that many AI startups and research labs cannot afford, and even if they have the capital, they cannot secure supply fast enough. Even miners repurposing H100 clusters face export restrictions.

This confluence of supply bottlenecks, surging demand and capital barriers creates a need for credit markets for AI hardware. USDai’s founders position the protocol as an “InfraFi” layer, similar to how oil created the petrodollar, USDai will be that for AGI financing. Elon Musk estimates the global AI infrastructure gap at $490 billion. If even a fraction of this is financed via decentralized pools, the yield potential could be meaningful.

How USDai Captures Yield

USDai’s yield comes from AI compute rentals, not trading fees or inflationary emissions. Borrowers pledge GPUs through the CALIBER framework. Hardware is tokenized as an ERC-721 NFT and held in a bankruptcy‑remote SPV, ensuring USD.ai retains legal title. This creates an enforceable electronic document of title that separates legal ownership from operational control. If a borrower defaults, the collateral can be repossessed and auctioned via a Queue Extractable Value (QEV) mechanism.

As demand for GPU rentals rises with generative AI adoption, yields could remain attractive relative to RWA‑backed stablecoins (currently 4-10% APY from T‑bills or private credit).

Over time, as more hardware comes online, a greater share of the yield will derive from AI infrastructure rather than T‑Bills, bringing target yields up to an expected 12-20% (unofficially) based on current rental rates.

Allo Farming Game

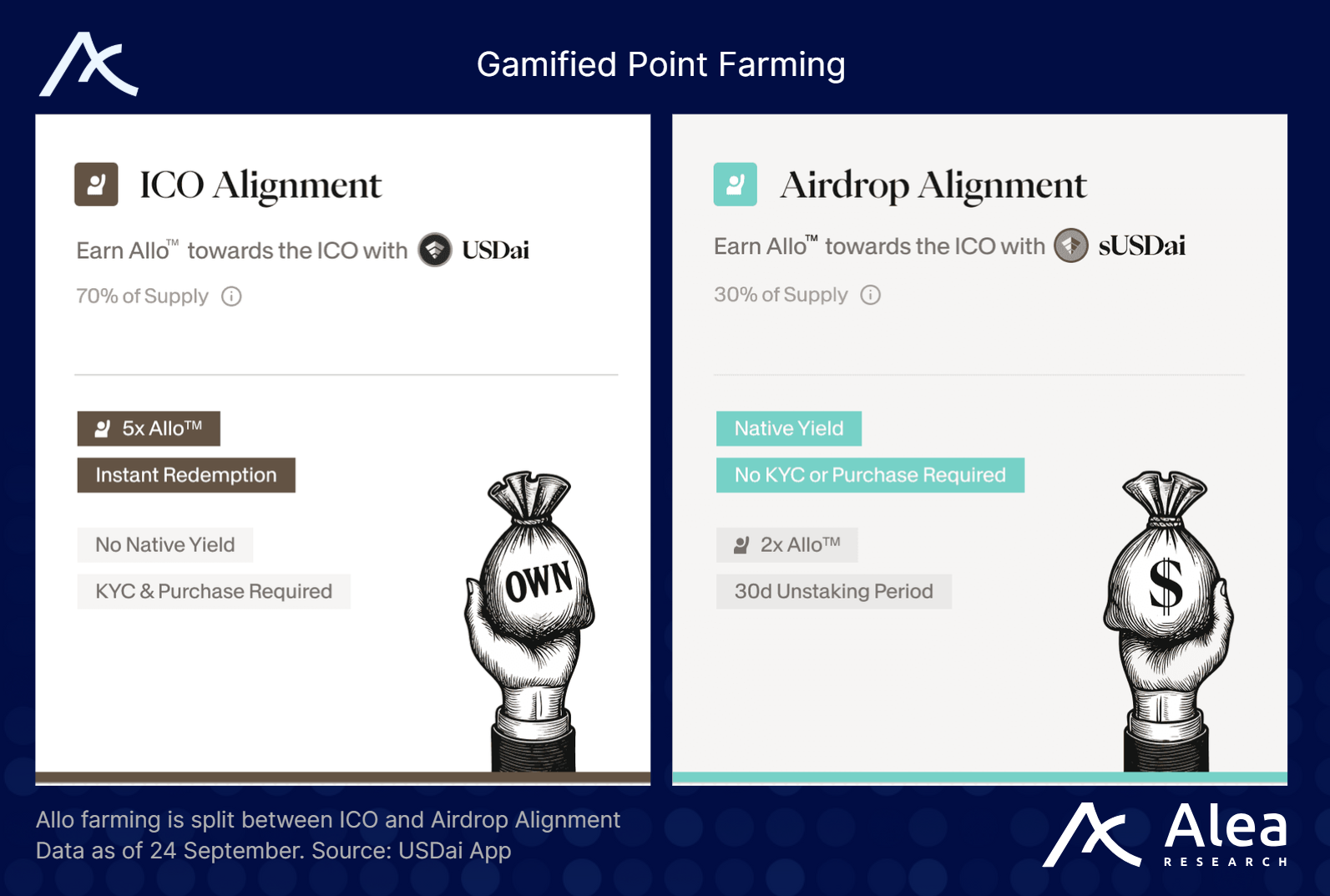

To align early users with long‑term incentives, USDai introduced the Allo Game. Participants earn Allo for minting and staking USDai, with each dollar deployed generating points daily. Points are split into two alignments:

ICO Alignment - earned by minting and holding USDai. These points entitle holders to a share of a future token sale, where 70% of the token float is distributed to ICO participants.

Airdrop Alignment - earned by staking USDai as sUSDai. These points give airdrop allocation representing 30% of the token float. sUSDai holders also receive rental yield and additional points when using strategies like Pendle YT boosters or LP vaults.

The Allo Game will continue until USDai has paid out $20 million in yield.

At that milestone, the protocol will unlock 10 % of its token supply at a $300 million FDV where 70% of this float goes to ICO‑aligned users and 30% to airdrop‑aligned users. $300 million is the same valuation that early investors got in at, ensuring that early contributors and public participants enter on equal footing.