Crypto derivatives have grown into a trillion‑dollar market, yet the infrastructure for trading and settling these products remains fragmented. Retail users face limited asset listings and value leakage to external market makers, while institutions still negotiate OTC deals manually via Telegram and spreadsheets.

Variational is an on‑chain peer-to-peer protocol for trading, clearing, and settlement of perpetuals and complex derivatives. Their mission is to create a neutral, scalable infrastructure where retail traders can access thousands of markets with deep liquidity and zero fees, and where institutions can book bespoke OTC structures safely on‑chain.

In this edition, we’ll explore why existing derivatives markets fall short, how the Variational protocol works and what differentiates it, Omni launch, and More.

Stay informed in the markets ⬇️

Why Today’s Derivatives Infrastructure Needs Reinvention

The team behind Variational observed three major gaps while providing liquidity on every leading CEX and DEX:

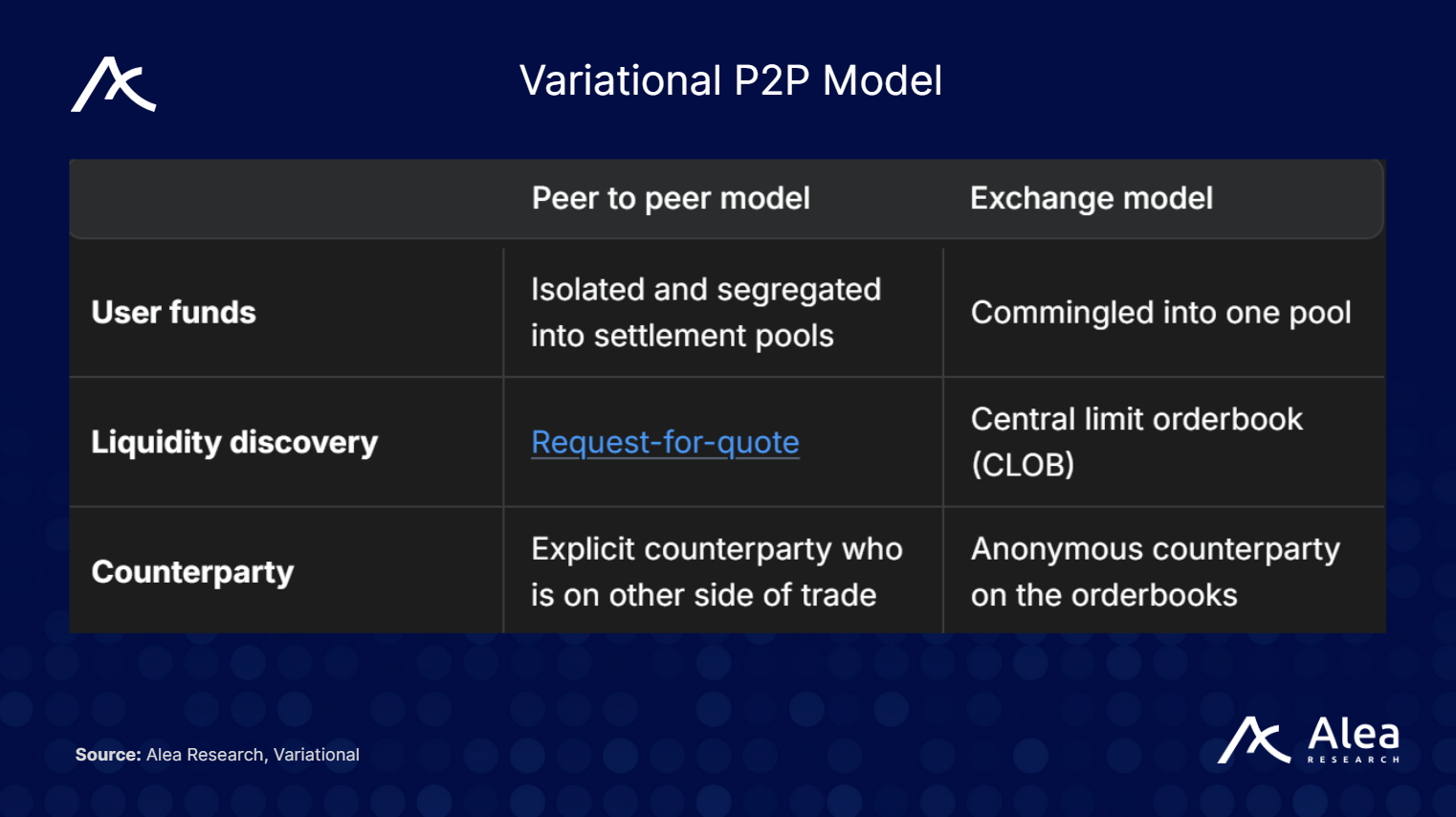

Value leakage to external market makers. Existing exchanges mix user funds in a single pool and rely on independent market makers to provide liquidity, causing a constant flow of money from traders to market makers through spreads and fees. This setup incentivizes platforms to charge taker fees up to 60bps, significantly raising execution costs for active traders.

Limited market support. Listing new markets is slow because exchanges depend on external liquidity providers. Long‑tail tokens, pre‑launch assets and exotic instruments are rarely available, forcing traders to speculate on only a handful of majors.

Manual OTC trading for institutions. Institutional derivatives trading still relies on manual processes like negotiating via Telegram, sending spreadsheets, and wiring collateral directly to counterparties. This leads to operational overhead, limited price transparency, and heightened counterparty risk.

Variational aims to solve these inefficiencies by building a protocol that enables non‑custodial bilateral trading with segregated risk, automated settlement, and a vertically integrated market making vault. This architecture supports both retail and institutional use cases through two flagship applications: Omni for permissionless perpetuals trading, and Pro for custom OTC derivatives.

Variational Architecture

Variational instead uses segregated settlement pools, which are smart contracts that contain positions, collateral and margin rules for each pair of counterparties. Each user on Omni has their own bilateral pool with the Omni Liquidity Provider (OLP). This design eliminates contagion: the bankruptcy of one pool does not impact others.

However, counterparty risk is that the collateral in a pool is the only funds available to settle trades. This is a tradeoff that Variational manages through robust margin and liquidation rules.

Variational’s core margin and liquidation engine calculates required margin and handles liquidations per settlement pool, ensuring that a liquidation in one pool does not affect others.

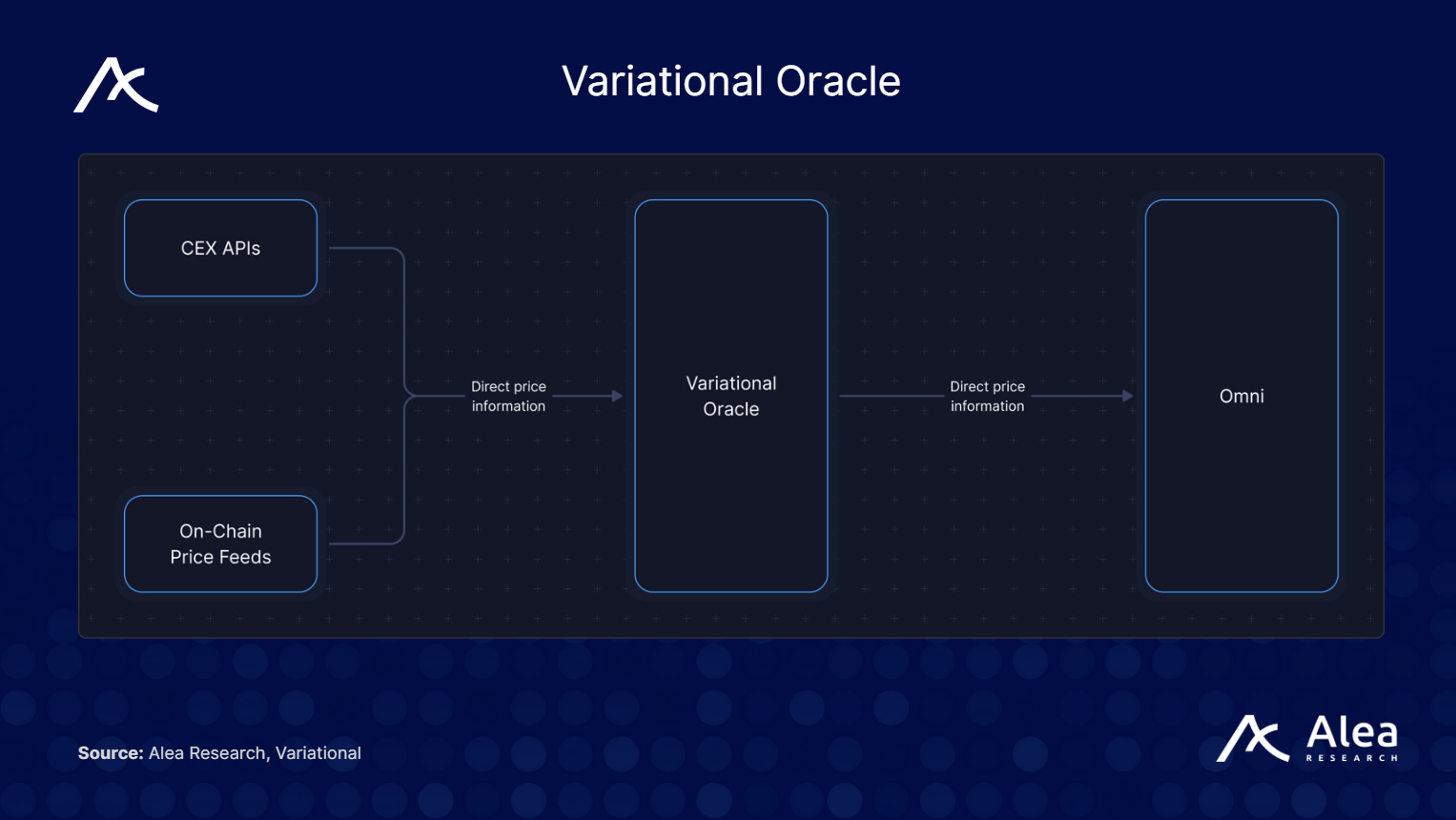

Another key enabler for permissionless derivatives is the Variational Oracle, an in‑house price feed that aggregates data from both centralized and decentralized exchanges. For tokens with sufficient CEX listings, the oracle uses a weighted combination of prices to guard against manipulation. For long‑tail assets without CEX listings, it falls back to on‑chain data from AMM pools across blockchains and rollups.

This modular design allows Variational to price almost any token instantly and even support non‑crypto markets (e.g., gold or prediction markets) by adding dedicated data streams.

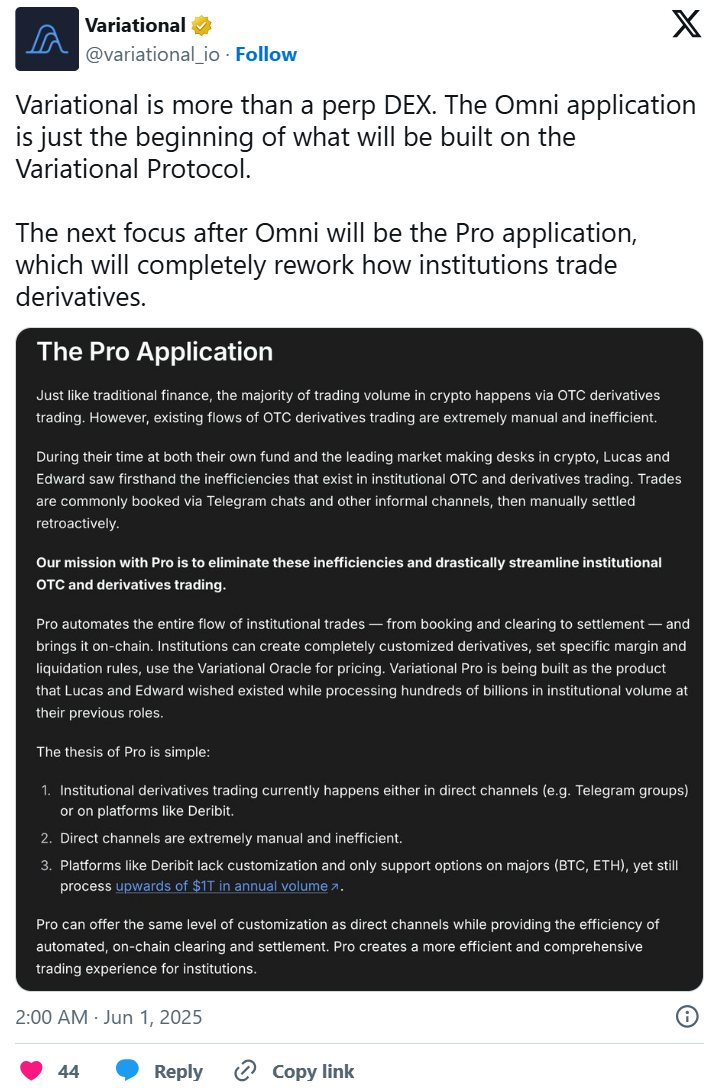

For institutional traders, Variational Pro unlocks fully customizable derivatives trading. Current OTC markets rely on manual chat groups and bespoke contracts, leading to high operational overhead and counterparty risk.

Pro automates this entire workflow allowing institutions to create an RFQ describing a desired derivative, multiple market makers respond with competing quotes, and once selected, both parties deposit collateral into an on‑chain settlement pool.

Omni: Permissionless Perps for Every Token

Exponential growth in token speculation driven by new protocol launches exposed the limitations of CLOB-based. Long‑tail assets often suffer from illiquid or nonexistent perp markets, and new listings depend on centralized gatekeepers like Binance Launchpad or Coinbase.

Omni solves these bottlenecks by leveraging Variational’s peer‑to‑peer infrastructure and vertically integrated market making. Traders can take long or short positions on new, pre‑launch and points markets before major exchange listings, democratizing access to early opportunities.

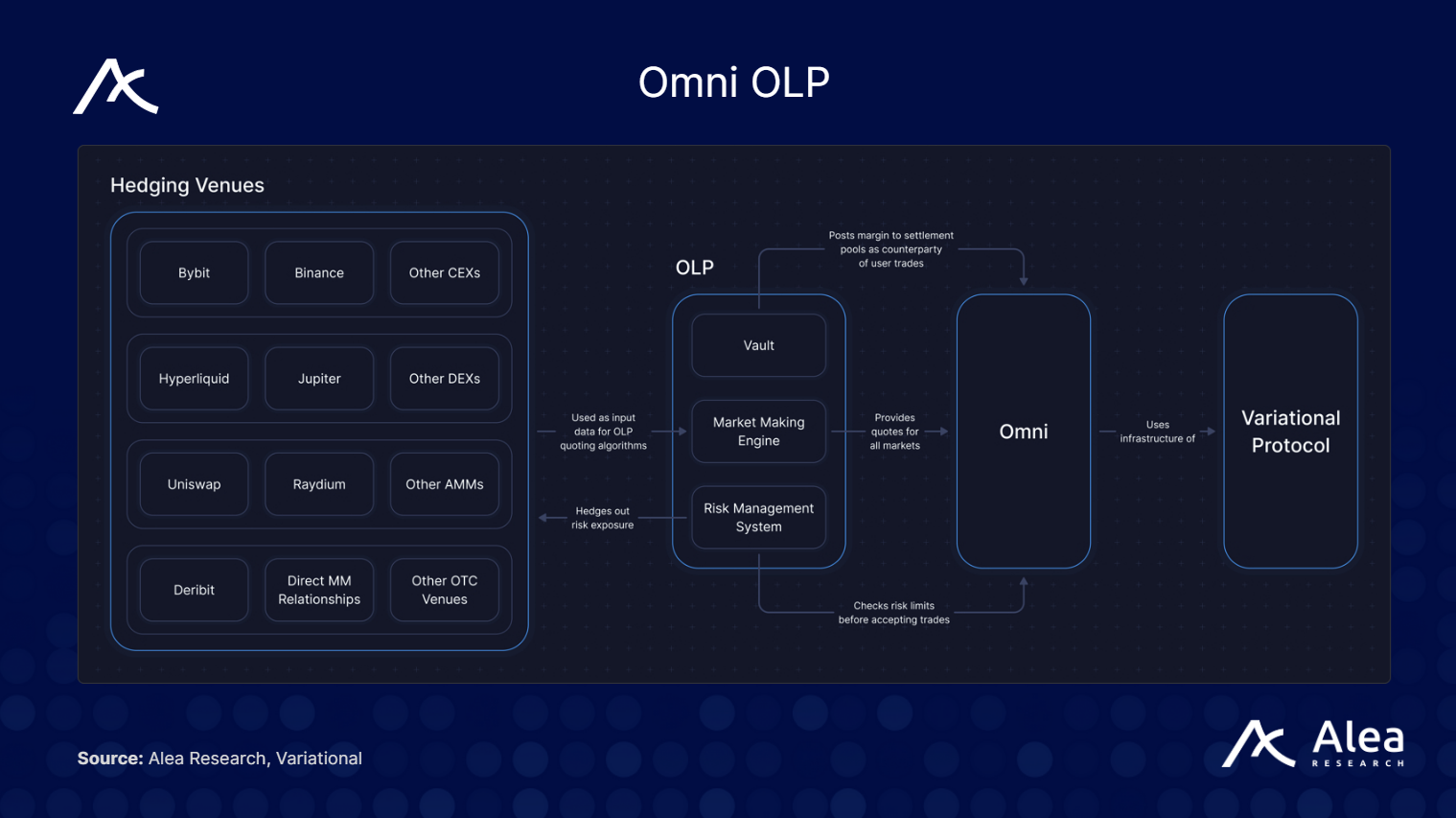

Omni’s automated listing engine ensures that new tokens with sufficient liquidity, decentralization and security checks are listed immediately, enabling thousands of markets. OLP aggregates liquidity from CEXs, DEXs and OTC venues, running sophisticated algorithms to quote tight spreads and hedge positions across markets. Every user has an isolated settlement pool with OLP, which limits contagion and socialised losses.

Revenue is generated from the spread captured by OLP, the sole counterparty, instead of charging user fees. Because OLP’s liquidity comes from a vault funded by the community, the majority of spread revenue is distributed back to depositors as yield, while a small percentage goes to the protocol.

This aligns incentives: OLP is motivated to keep spreads tight to attract volume, depositors earn yield from market making, and traders enjoy low execution costs.