Private markets move at lightning speed where AI labs raise billions, rocket companies land new contracts, and robotics startups capture headlines.

Yet the public has almost no way to participate.

Startups stay private for years with most of the value creation happening behind closed doors. Ventuals aims to change that by positioning itself as the market structure for turning startup/private company valuations into tradable perpetual futures. Built on Hyperliquid’s HIP‑3 standard, it promises instant settlement, deep liquidity and no gas fees.

In this edition we’ll cover what Ventuals is, how its architecture brings pre‑IPO valuations on‑chain, and comparisons with existing pre‑market listings.

Stay informed in the markets ⬇️

Intro to Ventuals

In the 1990s, companies like Netscape went public within 16 months of inception. This was largely attributed as the landmark event that kickstarted the dot-com boom, IPOing at $3 billion and giving everybody a “Hyperliquid effect” equivalent in the stock market.

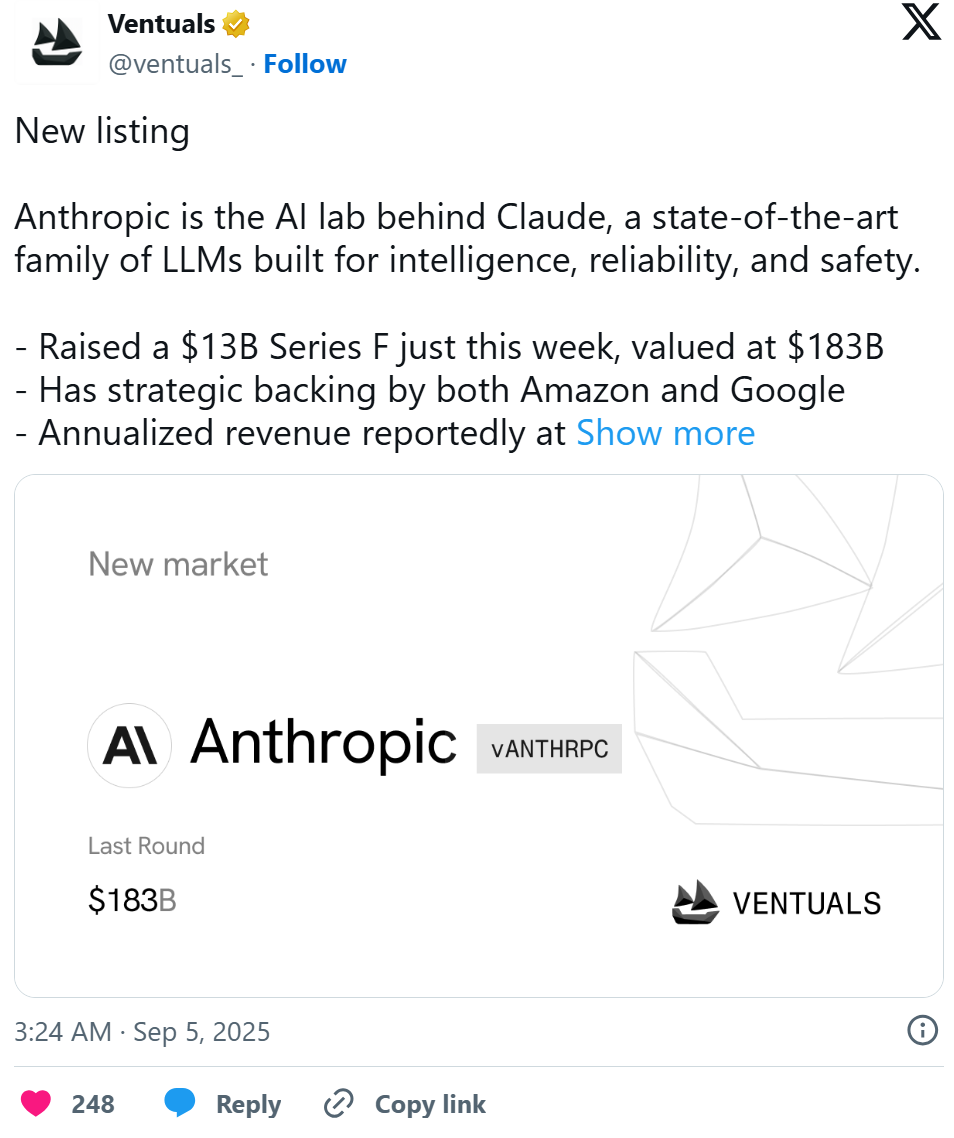

Ventuals’ core thesis is that metrics that signal technological progress and adoption such as product velocity, user traction, public perception deserve their own derivatives markets. Today, giants like OpenAI, SpaceX, Anthropic, and Stripe remain private for years, with most gains accruing to insiders.

Ventuals aims to democratize access to these private companies by letting anyone go long or short on a startup’s valuation before an IPO. Each “valuation unit” divides a company’s valuation by one billion. This approach democratizes access to a multi‑trillion‑dollar private‑equity asset class.

For example, a $350 billion OpenAI becomes vOAI priced at $350.

Taking a position in these simply express directional bets on valuation changes rather than ownership of the underlying stock. To-date, Ventuals has attracted over 20,000 testnet users.

Architecture: HIP‑3 and Valuation Futures

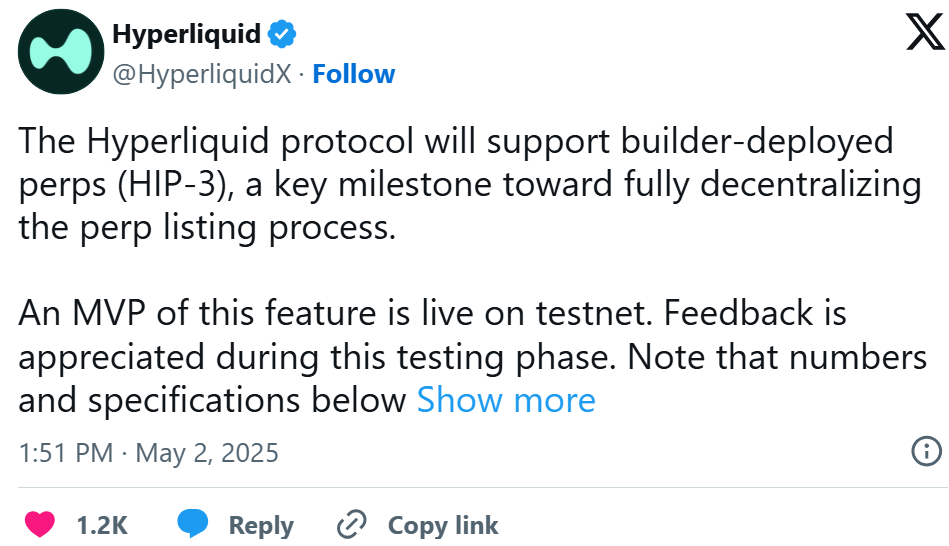

Ventuals is built using Hyperliquid’s new HIP-3 standard which allows builders to deploy permissionless perpetual markets directly on the network. Ventuals uses HIP‑3 to define the asset being traded, pricing rules and market participants, while Hyperliquid handles matching, settlement and risk management.

To create reliable price feeds, Ventuals runs an optimistic oracle, blending off‑chain valuation data (funding rounds, secondary market quotes) with on‑chain perp pricing.

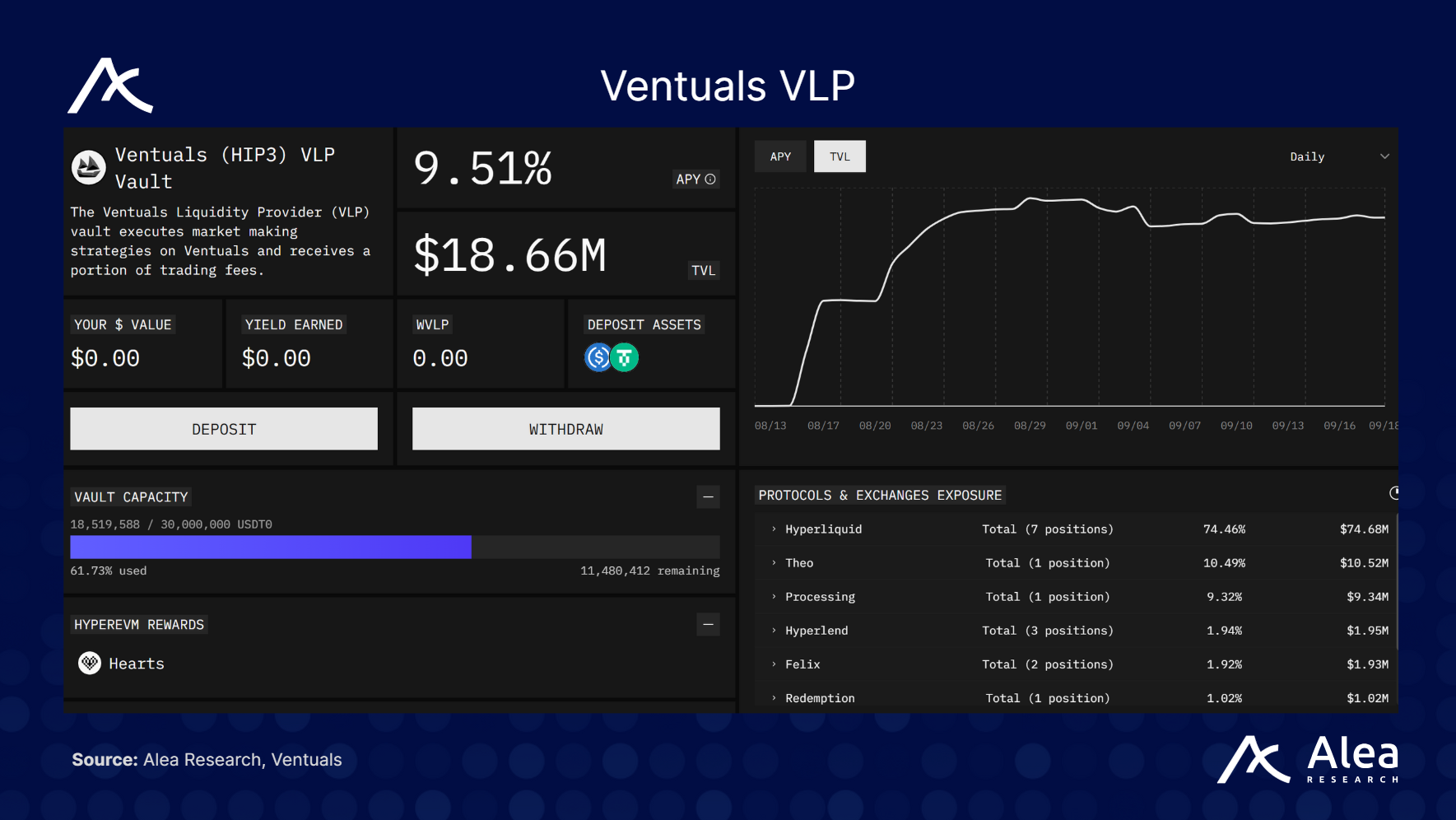

Liquidity is provided via the Ventuals Liquidity Provider (VLP) vault, a HIP‑3 LP vault hosted on HyperBeat. Pre‑mainnet, users can deposit stablecoin like USDC and USDT to earn competitive yield. Once mainnet launches, VLP capital will execute market‑making strategies and share P&L with depositors.

Experienced market makers can also run their own strategies on Ventuals similar to being on Hyperliquid. This dual approach of community vault plus professional makers aims to ensure deep liquidity and reduce the thin order‑book problems.

“Pre-IPO” Listings in DeFi

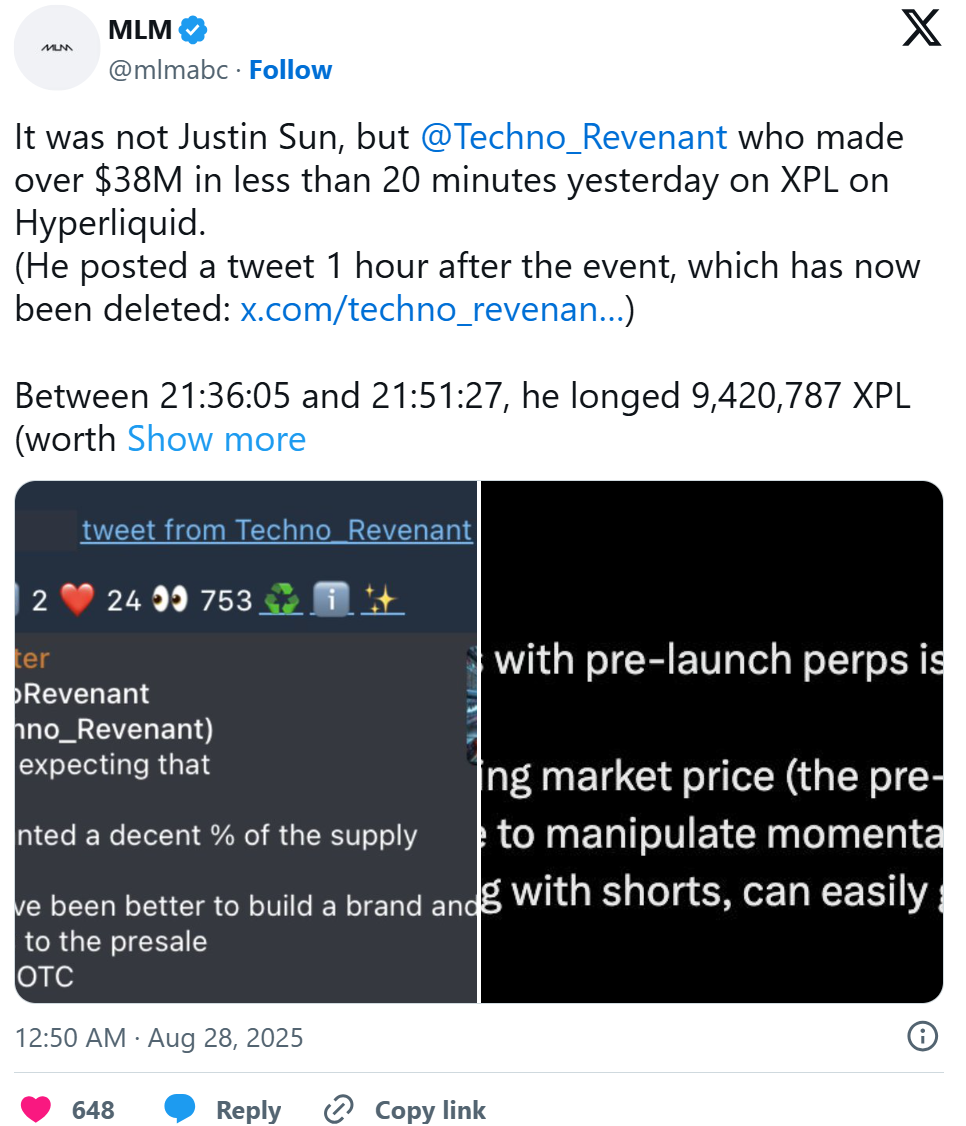

Ventuals arrives amid growing interest in pre‑market exposure with exchanges like Aevo (conceptualized it), Hyperliquid, and now even CEXes like Binance listing pre‑launch tokens or pre‑IPO instruments. Liquidity however, remains dangerously thin on some of these platforms.

A recent flash short squeeze into thin books on Hyperliquid’s pre‑market for Plasma’s XPL token illustrates the risk where a coordinated whale pumped the price from $0.60 to $1.80 in minutes, liquidating shorts and wiping out 85% of open interest which caused estimated losses of up to $60 million.

Investigators attributed the incident to extremely thin liquidity and the ease of manipulating an isolated oracle for an unlisted token that is heavily short hedged. Such events show that premarket futures without robust liquidity and safeguards can lead to extreme volatility and unfair liquidations.

Ventuals aims to mitigate these risks by using valuation units (rather than tokens) to deter speculative pump‑and‑dump because there is no supply overhang, or float dynamics. Each contract is purely a derivative on a company’s perceived valuation, not a tradable asset itself. Nevertheless, traders should remain mindful of the volatility and risk inherent in leveraged derivatives on unlisted companies.

Takeaway

By transforming startup valuations into on‑chain perpetual futures, it invites everyday traders to participate in the upside (and downside) of companies like OpenAI or SpaceX long before IPO day.

If executed well, Ventuals could become the de facto exchange for tokenized private companies, allowing the broader public to participate in what was once a private, mostly insider market.